Binance Somehow Avoided FDIC Censure

In July of 2022, the Federal Deposit Insurance Corporation (FDIC) issued warnings to crypto exchanges and crypto news sites for describing crypto exchanges as “FDIC-insured” that were not.

Companies like Voyager Digital and FTX would receive letters from the FDIC indicating they were in violation of Section 18(a)(4) of the Federal Deposit Insurance Act for “representing or implying that an uninsured deposit” is insured, with the possibility of a cease-and-desist order or financial penalty to follow.

Crypto news sites like Cryptonews.com and Smartassets.com would receive similar notices for conveying FDIC information about exchanges like Coinbase, eToro, Crypto.com, and Gemini. All of those sites have since removed any reference to exchanges being FDIC-insured.

For FTX, the issue was with a Twitter post from an FTX executive stating that “direct deposits from employers to FTX US are stored in individually FDIC-insured bank accounts in the users’ names.”

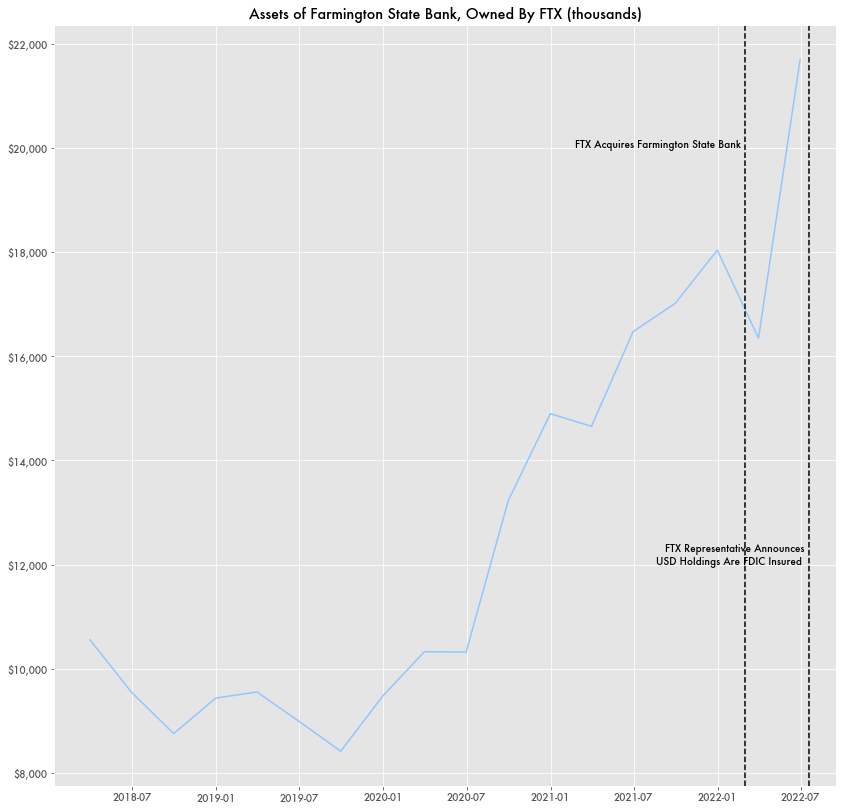

The FDIC doesn’t insure crypto exchanges, but they do insure U.S. banks. FTX had recently taken over a small bank in Washington state, Farmington State Bank, and the tweet was ostensibly related to potential FTX deposits of U.S. dollars there—not cryptocoins.

If FTX had individual accounts for their users at Farmington, they weren’t holding very much. Based on FDIC data, Farmington Bank has very few assets—less than $22 million by the second quarter of 2022 when the tweet was made.

According to a recent New York Times story, the bank’s deposits increased by $84 million in the third quarter. The majority of those deposits came from just four new accounts. Third quarter data is not currently available online.

No Letters For Binance

Yet Binance, one of the largest crypto exchanges based in Taiwan, did something similar in 2019 and appears to have avoided the FDIC’s ire. There is no evidence the FDIC contacted Binance to take down any reference to FDIC insurance, and prominent websites describing Binance as being FDIC-insured for U.S. dollar deposits are still online.

At a time, Binance had an agreement similar to that of FTX and Voyager through an affiliated bank, Silvergate. Silvergate is known for working with crypto companies, but Binance and Silvergate ended their agreement in June of 2021.

While websites that describe Binance dollar assets as FDIC-insured are still up, including in large publications such as Yahoo News, Cointelgraph, and Nerd Wallet, Binance has since removed a blog post describing their banking arrangement.

In that deleted post, Binance described their arrangement as:

“The pooled custodial accounts are maintained in a manner that provides access to pass-through FDIC insurance coverage up to the depositor coverage limit, which is currently $250,000. FDIC insurance coverage protects depositors against the risk of loss in the event that an FDIC-insured bank fails.”

With the article’s deletion, no description of FDIC insurance appears on the Binance site. Without the agreement with Silvergate, there is no indication if Binance USD holdings have access to pass-through FDIC insurance.

Binance also reportedly works with another financial institution, Prime Trust LLC, but there is no indication that it is FDIC-insured. The archived page on the Binance site about their agreement is empty.

Other Instances of Cryptos Promoting ‘FDIC-Insured’

Other crypto companies also offer some variation of FDIC-insured funds on their websites without any issue from the FDIC, such as Gemini and Paxos. Paxos mints a stablecoin branded with Binance, called BUSD. USD funds related to that coin may be in FDIC-insured accounts at U.S. banking institutions like Silvergate and State Street.

But even this might be misleading as Steven Kelly, Senior Research Associate at the Yale Program on Financial Stability, noted on Twitter that FDIC insurance only protects certain accounts at a bank, not anything and everything related to the bank, and that the limit is $250,000 per bank account. Crypto exchanges may only have one account for the exchange itself, not one for every user on its platform, so it would only be insured for $250,000 in total for all users of the platform.

Yet at a time, the Gemini website advertised that GUSD accounts “are eligible for FDIC insurance up to $250,000 per user while custodied with State Street Bank and Trust.” That language has since been removed.

In 2019, hackers stole $40 million worth of bitcoin from Binance, but the exchange announced that it would fund all the users affected by the hack using a Secure Asset Fund for Users (SAFU)—a Binance emergency insurance fund sourced from trading fees on the exchange.