Current CPI-PPI Spread Lowest in Decades

The Consumer Price Index (CPI) is an average for the cost of goods to consumers that determines inflation or the relative value of currency. The Producer Price Index (PPI) is an average of prices received by domestic producers.

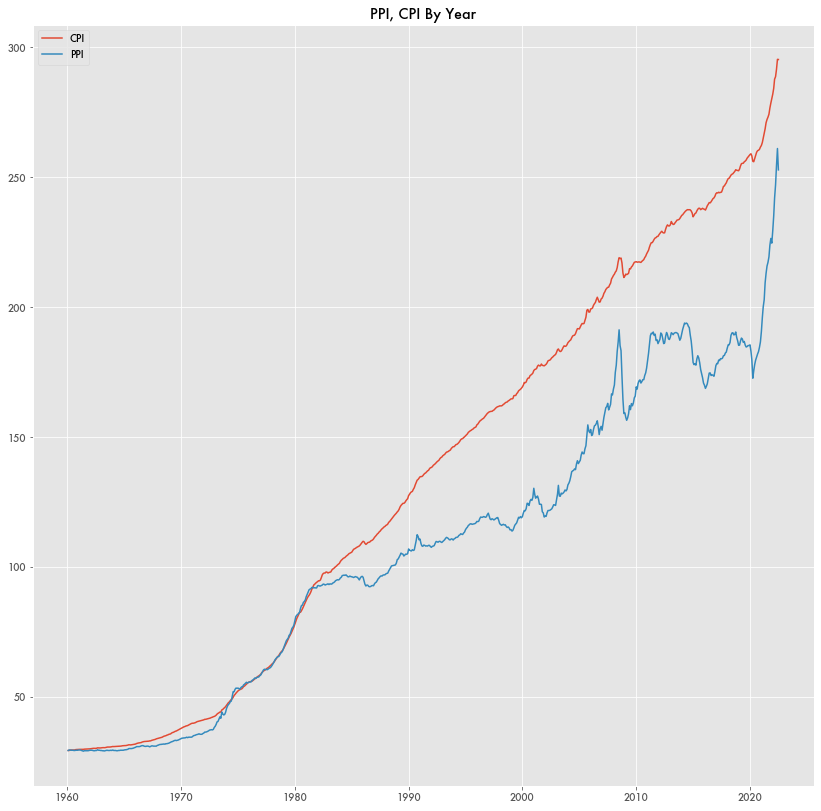

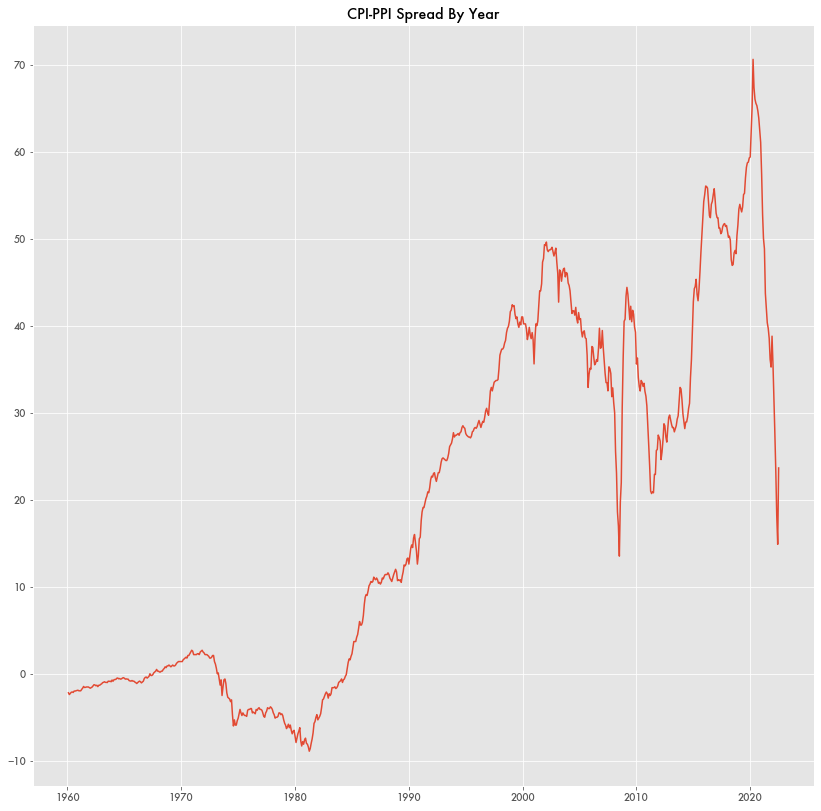

Throughout the 60s, 70s, and 80s, PPI and CPI were similar. The spread between the two—CPI minus PPI—hovered around zero.

Sometimes it was negative. With inflation in the 70s, they both increased in tandem. Following the recessions of the 80s, CPI increased at a much higher rate than PPI, and the spread widened.

A lower spread indicates a lower return for retailers. But it also indicates a higher return for producers relative to inflation.

PPI spiked for a short time following the financial crisis of 2007-2008, but the spread returned and only grew in following years.

But since the pandemic and recent inflation, the spread collapsed to lows not seen since the early nineties.

CPI increased (i.e. inflation) but PPI increased at a much higher rate—possibly due to higher oil prices, inflation, and and miscellaneous other pandemic causes.

In terms of PPI per CPI—an indicator of how much a producer might earn relative to their costs as a consumer—the rate is the highest it has been since the mid-eighties.

Similar to Beef Spreads

A previous Investigative Economics story highlighted the changes in spread between retailers and producers for beef. Similar to the CPI-PPI spread, rancher profit margins have been in stark decline since the 70s as retailer (i.e. grocery stores, butchers) profits grew.

Despite the attention they receive as an obvious monopoly, profits for wholesalers such as the big four processors—Cargill, JBS USA, Tyson Foods, and National Beef Packing—that dominate the meatpacking industry had barely changed over the same time. Only during the pandemic did those historic trends shift.