According to the Department of Energy (DoE) press release, the pause on liquid natural gas (LNG) exports by the Biden administration was only for new export authorization requests to non-free trade countries; Nothing that would really affect the U.S. economy.

The agency went so far as to outline a list of common misconceptions about the change to ensure there is no confusion that the Biden administration is trying to stop America’s LNG production because of climate goals.

While the move was intended to “enhance national security, achieve clean energy goals and continue support for global allies,” the change should not affect American jobs, energy prices in the U.S., or “already authorized or operating export capacity.”

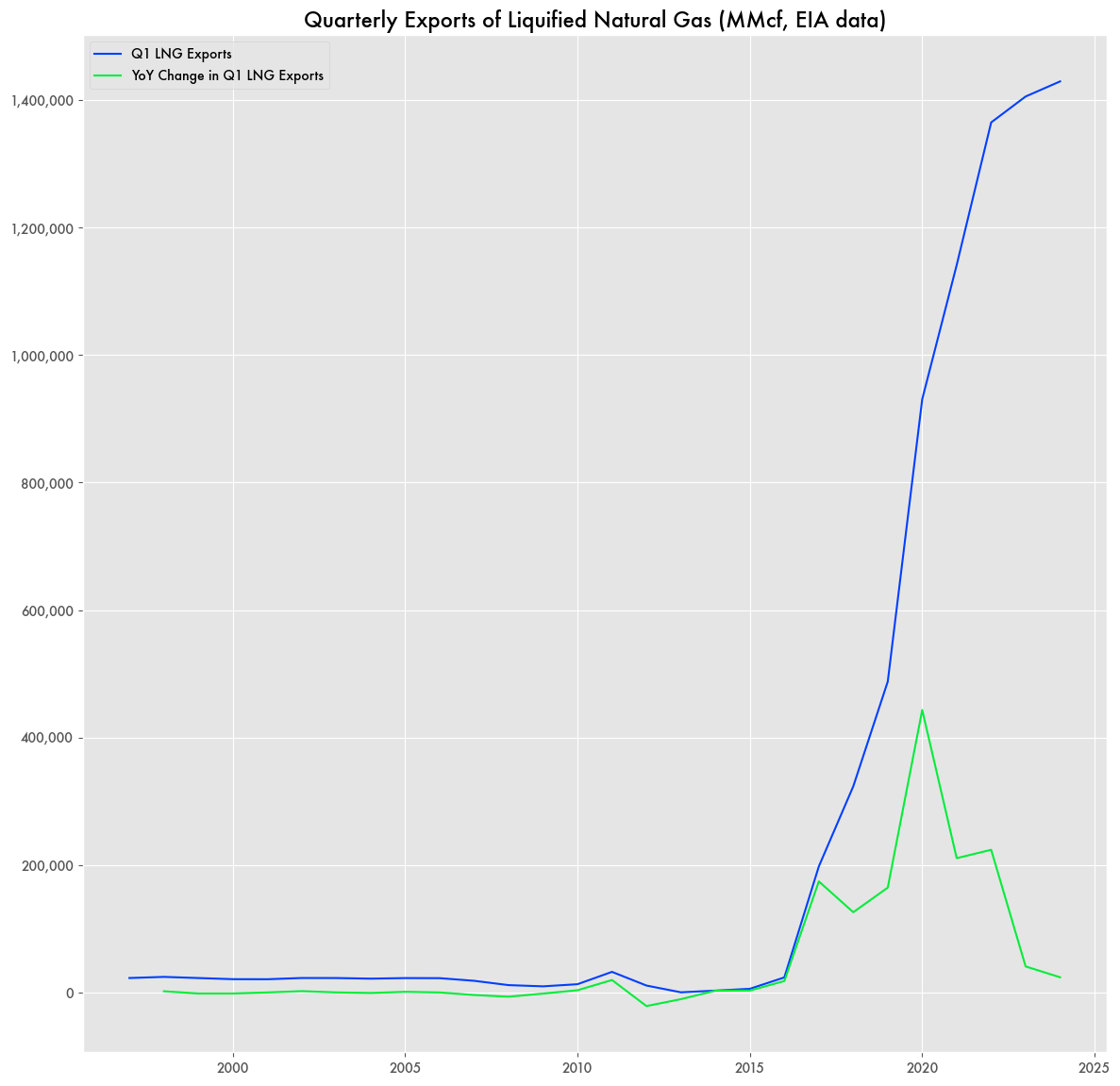

Yet, LNG exports have been in sharp decline since that decision was made. America’s natural gas boom had been driving LNG exports ever upwards over the last decade but have plummeted since January when the export restrictions were enacted.

According to data from the Energy Information Administration (EIA), monthly LNG exports dropped by 23 percent—92,484 million cubic feet of natural gas—between January and April. That was the largest three-month drop since 2020 and the third largest drop in the data going back to 1997.

There’s no concrete evidence that the policy change is what drove the decline in exports, but it is considerably coincidental. As of July, a federal judge put a pause on the export ban.

EIA Obscures the Drop

In its monthly reports, the EIA highlighted the current state of LNG exports for April as:

[The] highest daily rate of natural gas exports for the month since we began tracking them in 1973

Which is technically true, but practically every year has had a higher daily rate of exports than the last. Natural gas exports have been increasing year over year since the shale boom, and 2024 had the lowest increase.

The drop in exports for May would be the largest year over year decrease on record.

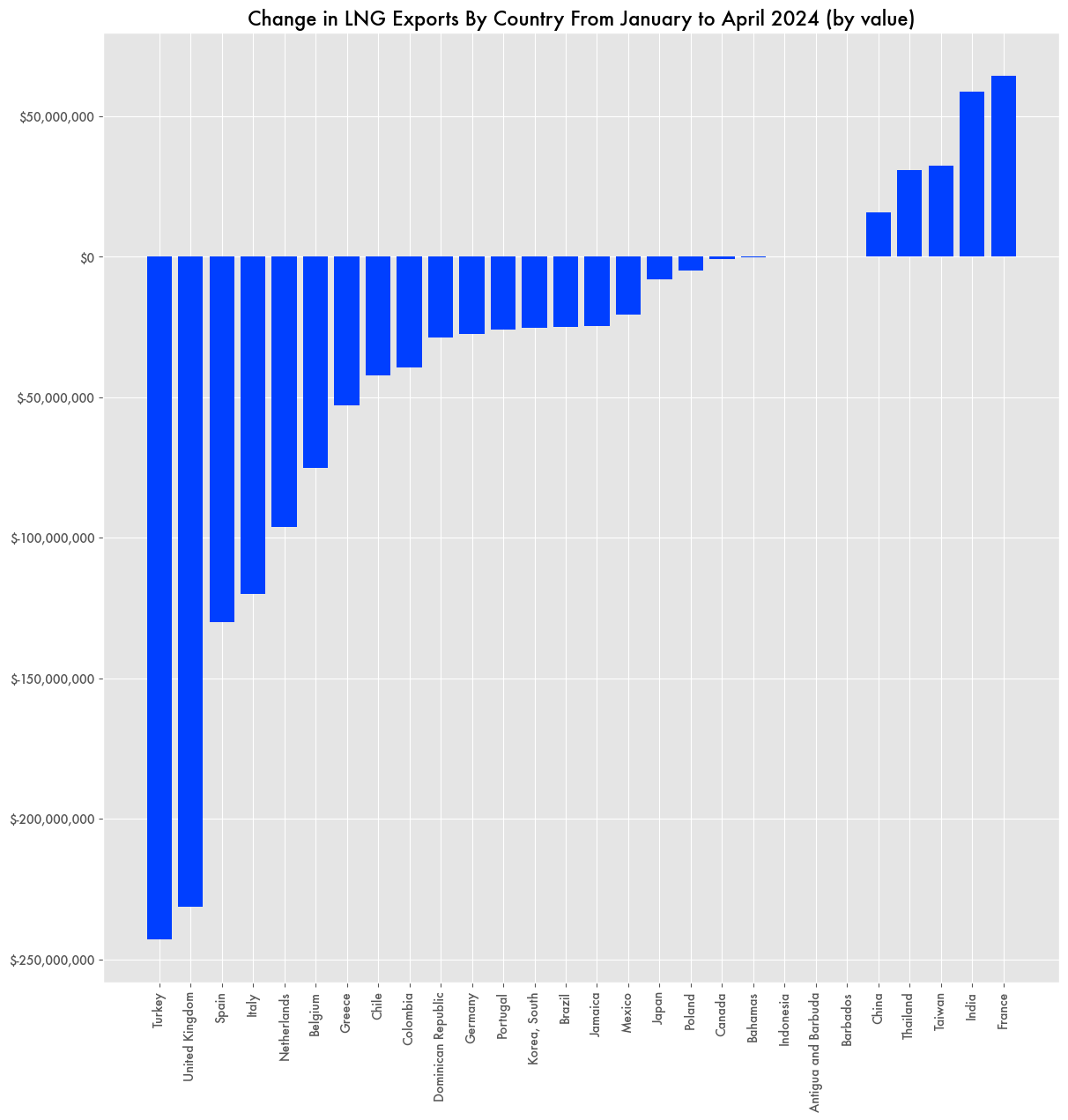

Change in Exports By Country

The Biden Administration’s limit didn’t seem to affect exports to countries without a free trade agreement either. China was one of the few countries that saw an increase in LNG exports, along with France, India, Taiwan, and Thailand. The U.S. does have trade agreements with China, but not a free-trade agreement.

Some countries with a free trade agreement, like Chile, Colombia, Dominican Republic, and South Korea, saw a decrease.

According to a 2022 Department of Energy policy document, the following countries have a free trade agreement with the U.S. with respect to natural gas:

Australia, Bahrain, Canada, Chile, Colombia, Dominican Republic, El Salvador, Guatemala, Honduras, Jordan, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, Republic of Korea, and Singapore

For the United Kingdom, which saw one of the largest declines in LNG imports from the U.S., they replaced U.S. LNG with that of Norwegian and Belgian LNG, although overall first quarter natural gas imports declined 26 percent compared to the year before based on data from the Department for Energy Security and Net Zero.

Seems like seasonality to me. You'd expect a big drop each spring. The raw size of the decrease will get larger as total capacity increases.

What's export capacity utilization over time?