Martin Shkreli's Stock Predictions Were Accurate Only in the Short Term

Martin Shkreli is the hedge fund manager infamously known for starting a pharmaceutical company that bought up a life-saving drug under orphan drug status, Daraprim, and hiked the price 4,000 percent.

Recently, Shkreli was banned from the pharmaceutical industry for life and ordered to pay out $64 million in profits for violating antitrust law in how the company blocked out generic competition and distributed the drug. He is also serving a seven-year prison sentence related to defrauding investors.

As a hedge fund manager, Shkreli frequently earned the ire of pharmaceutical companies by actively shorting their stock—investments that bet on the decline in their stock price—and publicly describing his position in intricately detailed blog posts that covered every aspect of a drug’s efficacy and a company’s financial health.

The advocacy group Citizens for Responsibility & Ethics in Washington (CREW) accused Shkreli of lobbying the Food & Drug Administration (FDA) while not disclosing his investments in the drug’s he was lobbying on. They also believed he was solely interested in short-term market manipulation.

While Shkreli's stock positions would follow short-term movements in a company's stock that would disappear in a matter of days or weeks, his prognostications would disappear in the long term. While some companies did fall into bankruptcy, more often than not the stock price grew substantially, sometimes after the company changed names and stock symbols.

Pharmaceutical/biotech companies like Mannkind, Horizon, and Ampio would be singled out by Shkreli on the investment site Seeking Alpha as shorting opportunities based on the weak potential of their drugs or their limited cash flow. His predictions often came at the same time that the company’s stock would suddenly spike and fall, proving his insight correct, or at least relevant.

But in the long run, their stock values would regain any losses experienced during that drop. The swift spike and fall surrounding Shkreli’s prediction appear as random blips more so than markets realizing critical flaws in the company’s worth.

At one point, Mannkind would quadruple its stock price from when Shkreli called it out. Humana fell to $2 a share when Shkreli highlighted it as a potential short investment. It would top almost $40 a share three years later.

Ampio went from around $8 a share when Shkreli wrote about them to around $3 a share in 2012. But then the company would top $10 a share in a matter of a couple years, although eventually the stock would collapse again.

According to an October 2021 Yahoo Finance story, an investment in Horizon Therapeutics in 2011 when Shkreli made his prediction of the company’s collapse would lead to a 2,000 percent gain.

Not all of his shorts would become stellar investments. Cytori Therapeutics was another short call by Shkreli who believed the penny stock would go from 18 cents a share to zero in a matter of months.

Cytori would eventually become Plus Therapeutics in July of 2019, and its stock too would collapse, losing a third of its value over the next two years. But it’s now up to 86 cents a share.

One company that did fall into bankruptcy was Neoprobe. In 2011, Shkreli predicted a collapse in the stock price of Neoprobe, manufacturer of Lymphoseek—a radioactive tracing agent, or lymphatic mapping agent, used to detect cancer in the lymphatic system. He predicted the price would go from $5.25 to 25 cents in a matter of a year. Shkreli also wrote citizen letters to the FDA asking the agency to deny the drug's approval largely because it was less effective compared to pre-existing mapping agents, such as blue dye with sulphur colloid.

But rather than keeping the short position, Shkreli ended the position August 5, 2011 after the price dropped only a small amount. Instead of rejecting the drug's application as Shkreli lobbied for, the FDA approved it. Neoprobe would eventually change its name to Navidea and the company's stock price would increase for a time. But in the following years the stock price would collapse with struggling sales of Lymphoseek and the company would fall into bankruptcy.

If Shkreli had held his short position for a longer time, it would have been a financial boon.

Shkreli’s Hedge Fund: MSMB

As manager of the hedge fund MSMB Capital, Shkreli would take on a massive loss during a naked short—betting on the fall in price of a stock without being in possession of the stock—of Orexigen Therapeutics, maker of a weight loss drug Contrave. Naked short selling can be highly risky as the investor may have to buy the stock after the fact to cover their position, which might be even higher than it was when they first made their bet.

Shkreli shorted the company when the FDA declined to approve the weight loss drug in June of 2011 out of concern for its potential effect on the cardiovascular system and additional clinical trials would be needed. A prior diet drug, fen-phen, was recalled by the FDA for its effect on cardiovascular system, leading to major class action lawsuits and billions in settlements.

But Orexigen's stock bounced back as the FDA worked with the company to eventually gain approval for Contrave in 2014. MSMB regularly lost money on its investments, but this time MSMB’s capital was wiped out with its bet against Orexigen, and Merrill Lynch would lose millions handling the hedge fund’s account. Contrave would go on to be a best selling weight loss drug.

Even though short-sellers like MSMB were looking at potential cardiovascular concerns from the drug, they weren’t looking at whether the drug was actually effective. Clinical trials showed that Contrave performed worse than a placebo for losing weight. Sales eventually fell and Orexigen would have to file for bankruptcy in 2018.

Other Public Stock Prognosticators

Shkreli is certainly not alone in the world of inaccurate stock predictions. Other public stock market analysts like Jim Cramer, host of Mad Money on CNBC, have been known to make unfavorable recommendations like investing in Bear Sterns days before the company collapsed and was sold for a fraction of its worth, insisting that the company was “fine” and “don’t take your money out.”

In a 2006 interview, Cramer is shown discussing hedge fund tricks to manipulate stock values for profit. In the interview he mentions that “you can’t foment” the impression that a stock is down, “but you do it anyway,” and there are ways to spread rumors and leak information to news outlets.

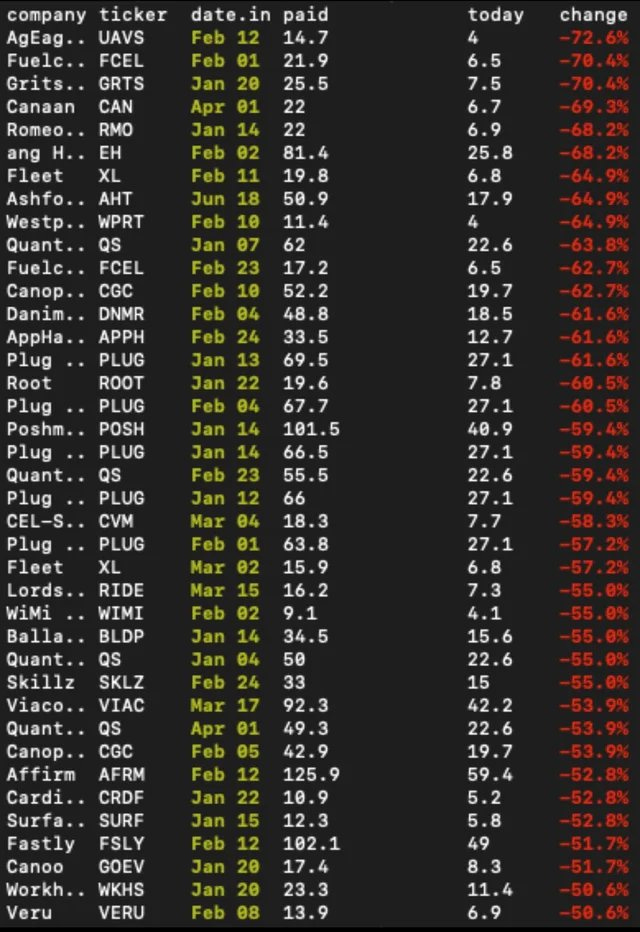

Compilations of Cramer’s recommendations and how they would lead to a regular loss in value have been shared extensively on the internet for some time.