Natural Gas Driving Electricity Prices Much More Than AI

According to various reports, AI is crushing the power grid. The intense demands of ChatGPT, Grok, and various other artificial intelligence services is so high that energy companies are struggling to keep up with demand and large costs will be passed on to ratepayers to upgrade the grid.

Bloomberg estimated that power companies are set to spend $1 trillion over the next five years for upgrades. A report from the Union of Concerned Scientists details how grid operators will likely spend billions to extend their distribution directly to data centers.

AI use is so synonymous with energy use that high-performance processing chips are sometimes measured by the gigawatts of energy they consume rather than their computational power.

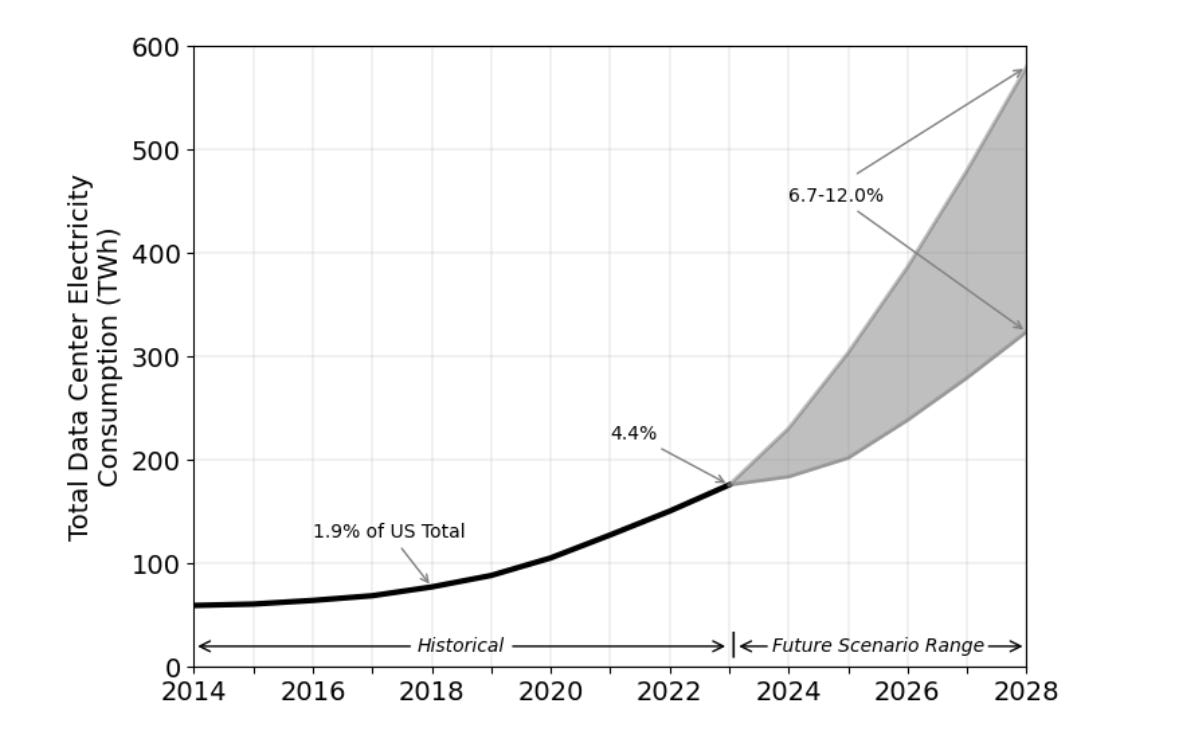

Certainly data centers use a lot of energy and AI has added to that. A Department of Energy report from 2024 listed data center energy usage at 76 terawatt-hours (TWh) in 2018 that would increase to 176 TWh by 2023, with various estimates at how much higher it can go in the future.

In December of 2024, Pennsylvania governor Josh Shapiro filed a complaint with FERC against PJM—the regional transmission operator (RTO) for the mid-Atlantic and parts of the Midwest that oversees wholesale electricity auctions—over its lack of planning for dealing with auction clearing prices hitting their maximum values. Eventually this forced PJM to reduce its maximum price cap.

Yet while electricity costs have increased in PJM states since 2021, most of that was due to natural gas prices, which doubled between 2020 and 2022 and is an ever-growing source of fuel generation. Natural gas represents 44.3 percent of energy generation in PJM in 2024—up from 17.8 percent ten years prior.

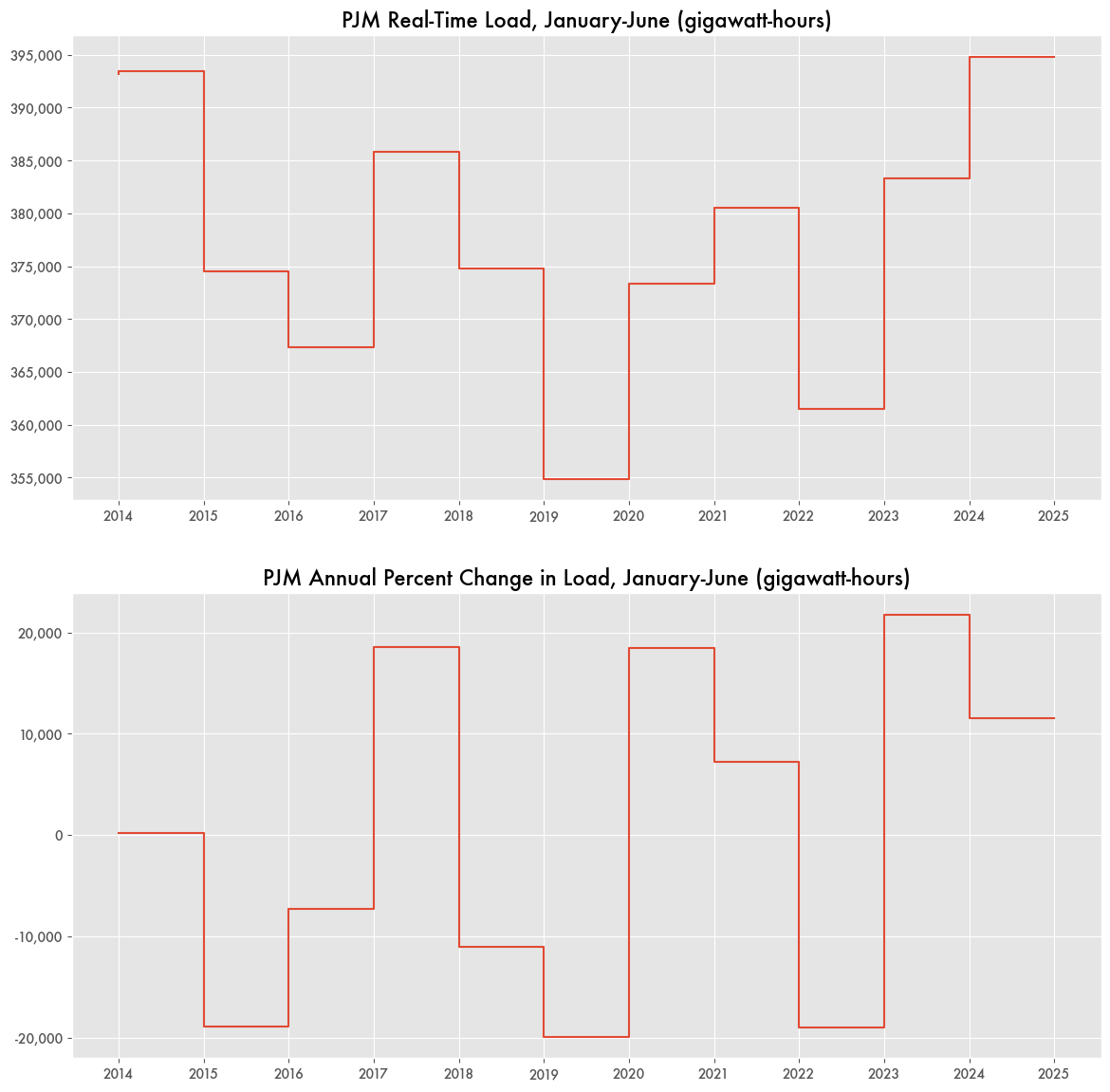

While electricity auction clearing prices certainly are at historical highs, that doesn’t necessarily translate to historically high costs for electric utilities. And while more electrical load brings on more operating costs, it’s not a significant driver of overall costs. Despite ever increasing data center energy usage year over year, total electrical load in PJM through June of 2025 was only slightly higher than the year before. Data center electricity usage has been parabolically increasing for over a decade, yet it only led to minimal growth in electrical pricing over that time.

Instead gas prices exploded around the time of the Russia-Ukraine war, leading to higher wholesale costs. The average increase in price for PJM states from 2020 to 2023 was 17 percent. For Pennsylvania residents, it was closer to 30 percent.

Virginia’s Increase

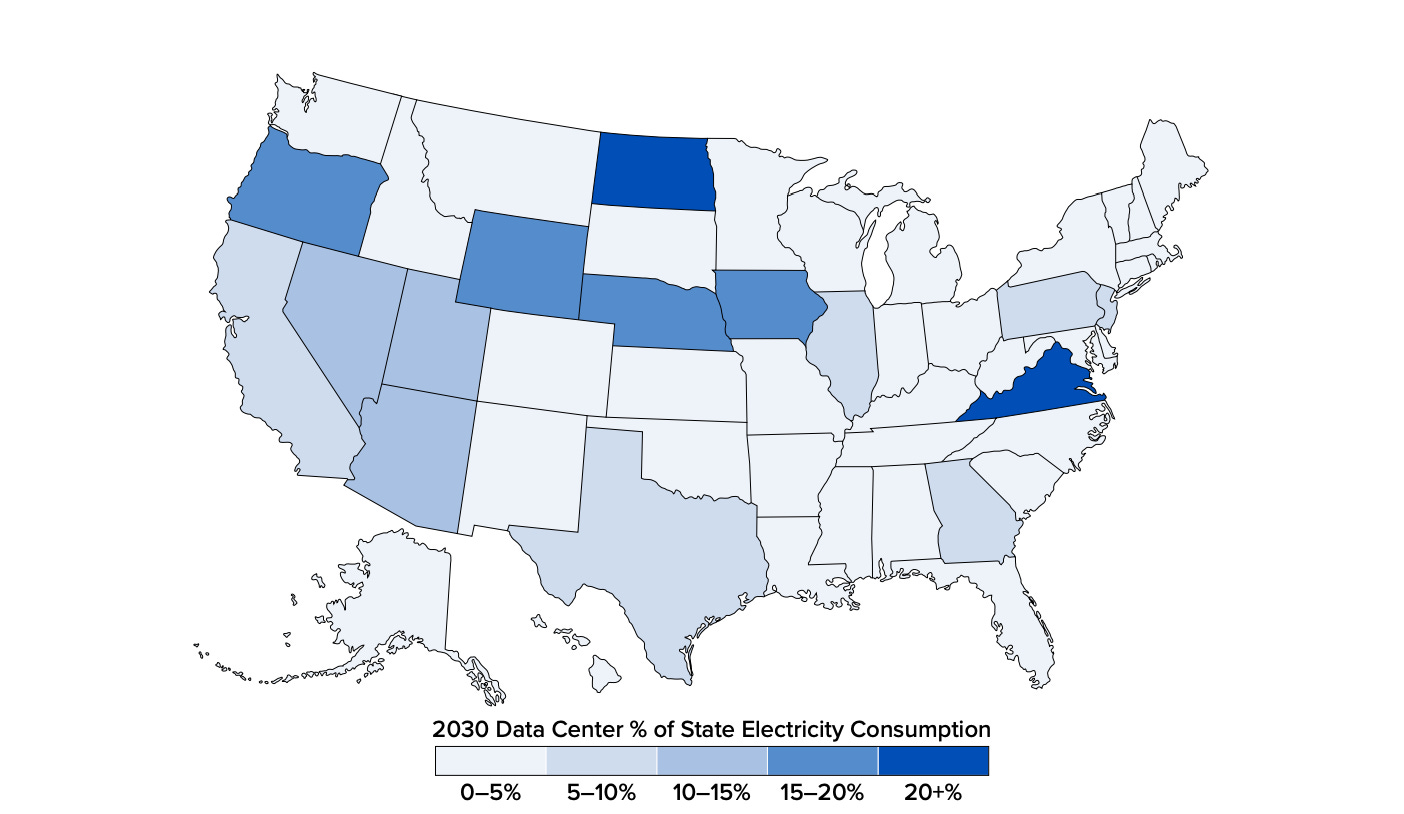

Virginia is easily the state with the most data center energy consumption, especially within PJM. Most of it coming from the Dulles corridor near Ashburn according to a 2024 white paper from the Electric Power Research Institute (EPRI).

Operating costs for Dominion Energy—an energy utility covering parts of Virginia near the Dulles corridor where many data centers are located—actually went down from 2023 to 2024 as AI got exponentially more popular and gas prices declined, and before PJM was forced to lower its price cap.

An April story from Virginia Public Media noted that Dominion is set to raise the base rate of electricity prices for end consumers by 15 percent—a rare occurrence and a significant amount. Half of it is dedicated to new projects like offshore wind farms and coal ash removal. But only about 9.2 percent of that increase is aimed at issues related to capacity auctions and increased load from data centers. A full 51 percent of the cost increase is due to recent spikes in natural gas costs and future projections of gas prices.

Natural Gas Dependency Feeds Into Capacity Prices

While natural gas prices are the larger portion of electricity costs, reliance on natural gas also affects the capacity auction pricing.

Times of peak generation are when wholesale electricity costs the most and when capacity auctions are most likely to hit their maximum values. Prices can rise exponentially as generation fuels are purchased at the last second on the spot market rather than in advance of need. Supply can fluctuate as intermittent sources, like wind and solar, are interrupted. More reliance on renewable energy has meant more reliance on natural gas to fill in the gaps. Natural gas generation can be interrupted by severe weather, as it did recently during winter storms in Texas and the Midwest, which affected PJM.

While natural gas has regularly become one of the cheapest sources of electricity, it is known to be spiky, with sudden price increases tens of thousands times the median fuel cost for small amounts.

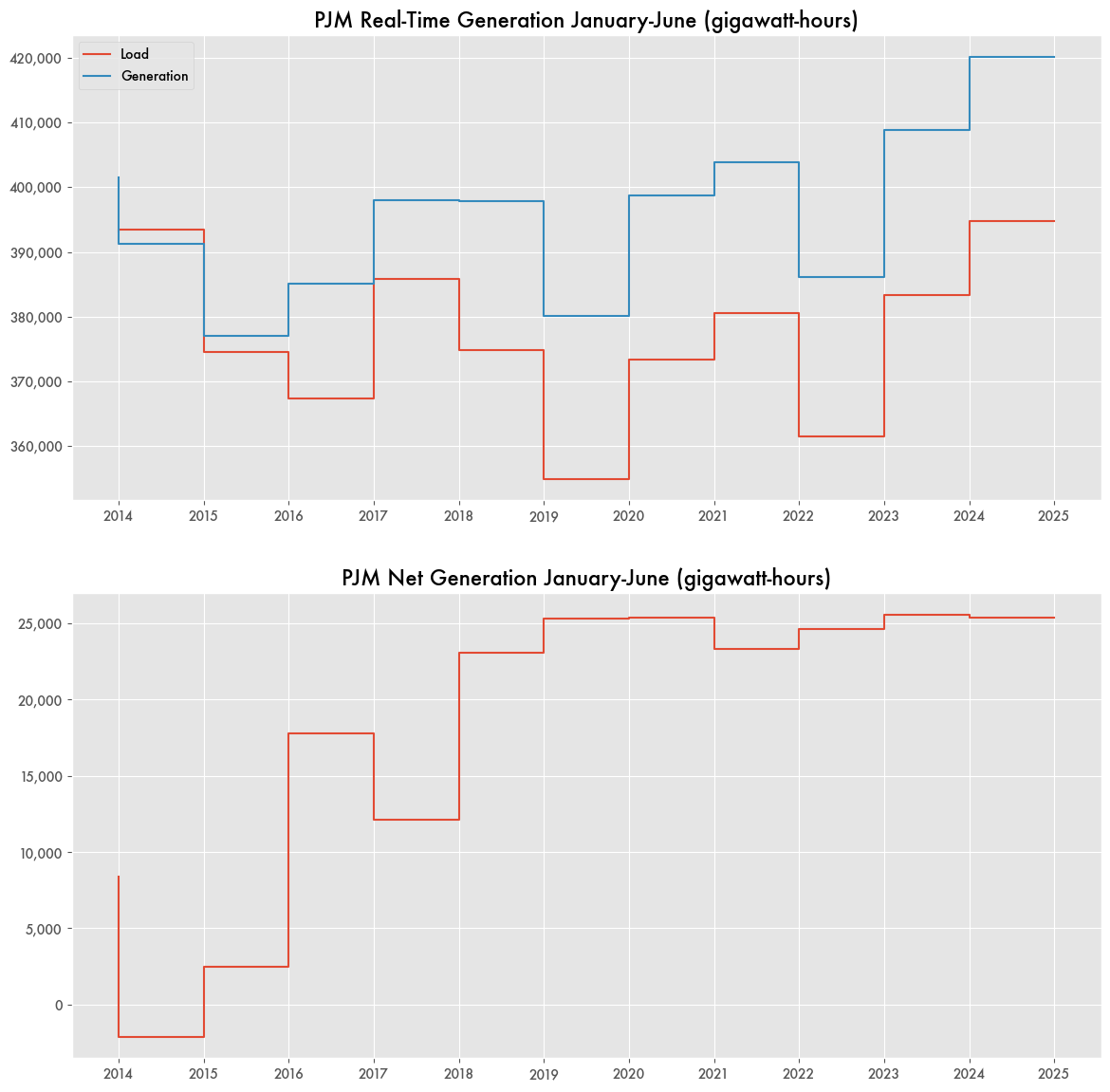

In PJM, the increasing dependence on natural gas has also meant a large gap between how much energy is generated and how much is needed. What was once below 5 to 10 terawatt hours for the first half of the year is now consistently above 25 terawatt-hours of excess generation.