Natural Gas Reliance Driving Resiliency Concerns

Fuel-related electricity blackouts have risen in recent years, and reports from energy industry analysts and regulators highlight the growing reliance on natural gas as a culprit because of the potential for distribution disruptions.

Power outages from fuel scarcity or supply disruptions are a relative rarity compared to weather disruptions of electricity lines. Up until 2010, there were never more than three reported electricity disturbances in the U.S. per year caused by a disruption of fuels, according to numbers from a Department of Energy database. But since 2010, those numbers have doubled on average alongside large-scale weather events like hurricanes and severe cold fronts with a record 17 incidents in 2014 alone because of the drastic cold temperatures during the polar vortex.

Although 2014 was a high-water mark for outages, no fuel-related incidents were listed for 2015, but the second highest total was registered in 2016.

While cheap natural gas has been a boon for energy generators, large-scale weather events have undermined its resiliency—the ability for energy utilities to recover from short-term, high-impact events. When these events cause outages at times of peak demand, utilities, local governments and consumers can be hit with large costs.

The total amount charged by regional transmission operator PJM charged customers in January 2014 at the peak of the polar vortex was one-third of the total billing of the previous year due to heavy energy usage and high gas prices.

The executive vice president of Natural Gas Supply Association (NGSA), Patricia Jagtiani, said that outages related to natural gas are still very rare and don't always directly affect consumers' electricity. She also said new rules from regional transmission organizations have helped value on-site fuel sources, or dual-fuel capacity, like coal and nuclear as a backup energy source.

Marty Durbin, American Petroleum Institute’s (API) vice president and chief strategy officer, said that infrastructure constraints from limited gas pipeline availability are part of the bottleneck affecting reliability.

Increased Natural Gas Reliance Leads to Resiliency Concerns

Because of the shale gas boom, natural gas now commands the largest percentage of net electricity, and daily prices for natural gas are now commonly cheaper than coal per megawatt-hour, according to the Energy Information Administration.

Energy regulatory and analysis groups released assessments of grid reliability and resiliency concerns in the last five years that pointed to potential risks from natural gas reliance, and the Department of Energy is set to release a report on the risks of diminishing use of baseload energy that could highlight the role played by natural gas.

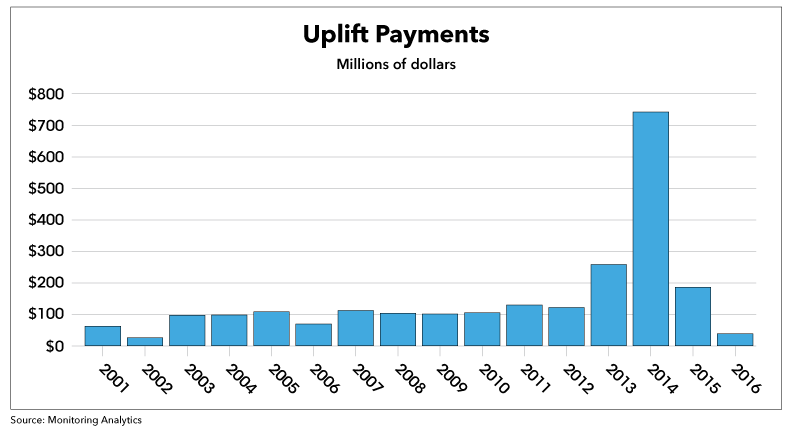

According to reports from the Federal Energy Regulatory Commission (FERC), North American Electric Reliability Corporation (NERC), Electric Power Research Institute (EPRI), U.S. Energy information Administration (EIA), and the National Academies of Sciences, Engineering and Medicine, heavy reliance on natural gas coupled with energy supply disruptions has led to electricity outages, short-term price spikes, and large uplift costs—government payments made to energy generators and other market participants to ensure reliable energy generation during unforeseen interruptions.

This includes a report from FERC on the 2011 cold snap in Texas, NERC’s assessment of the 2015-2016 Aliso Canyon leak at a natural gas storage facility, and EPRI’s 2016 assessment of outages following major hurricanes over the last decade.

NGSA's Jagtiani said that outages related to hurricanes are waning as natural gas production shifts from the hurricane-prone Gulf coast to the inland Marcellus and Utica formations.

None of those events impacted energy generation as much as the 2014 polar vortex. Record low temperatures in the Northeast and Midwest led to led to a sharp increase in energy demand alongside numerous fuel disruptions from frozen gas lines.

Generators were forced to purchase natural gas on the more expensive spot markets and electricity prices spiked to record highs as price ceilings were removed and various transmission operators made public appeals to conserve electricity.

Generators unable to produce energy incurred $597 million in uplift costs according to numbers from energy analysis firm Monitoring Analytics.

Polar Vortex Outages Preventable

Stu Bresler, senior vice president of operations and markets with PJM Interconnection LLC—a regional transmission organization and operator of the world's largest wholesale electricity market—said that a lot of the reasons for outages during the vortex, such as natural gas scheduling issues and frozen coal piles, were preventable.

"That's what PJM's new capacity rules were set up for: to tell operators that fuel unavailability is no excuse for poor performance," he said by phone.

Earlier this year, PJM developed new capacity rules that would allow higher payments for fuels that could ensure year-round generation.

According to a 2017 report from PJM, the rules were a response to lower energy prices, increased reliance on natural gas and disinvestment in power plants.

Additionally, the RTO servicing New England, ISO New England, recently instituted similar pay-for-performance rules.

Natural gas groups like the NGSA supported the new rules as providing greater fuel assurance even though it might support investment in other fuels like coal.

According to Paul Hibbard, principal with economic consulting firm Analysis Group, which works with the renewable energy industry, the capacity rules encouraged utilities to lean more on on-site backup fuels, like coal, that don't have transmission risks.

But the PJM report also says the new capacity rules are not enough to account for larger-scale disruptions, and heavy reliance on natural gas raises questions about fuel diversity and electric system resilience.

That reliance becomes a significant issue in the face of severe grid disruption events from weather or fuel disruptions—so-called Black Sky events—that would require 30 days of on-site fuel repository.

Jennifer Chen, an attorney with Natural Resources Defense Council's energy and transportation program and Sustainable FERC Project, said that the rules were unfair to renewables, which are reliable, but only for certain seasons in PJM's Midwest and mid-Atlantic market.

"The rules could easily be adjusted to require fuels to be available for half a year, rather than the whole year, which would allow solar and wind to compete [during times when they are more reliable]," Chen said by phone.

In June, the U.S. Court of Appeals for the District of Columbia Circuit sided with FERC's decision to uphold PJM's capacity market rules. (Advanced Energy Mgt. v. FERC, D.C. Cir., No. 16-1234, 6/20/17).

Potential for National Capacity Rules

PJM's Bresler supported coal and nuclear power as part of the fuel diversity mix.

"Right now markets are not valuing baseload coal and nuclear power, and the system of subsidies tends to interfere with efficient price formation," he said.

One alternative option is that new rules that ensure grid resiliency, akin to PJM's capacity rules, might help value coal and nuclear power because prices paid on the capacity market for would be higher to account for their reliability.

According to Bresler, "as a market construct it would be easy to implement—it could be put in place tomorrow—but it would have to be done on a federal level to affect all RTOs equally."

Paul Bailey, president and CEO of the American Coalition for Clean Coal Electricity, said that capacity rules might benefit coal since no other fuel can compete on the affordability of a 90-day pile of on-site coal as a backup fuel.

New York's Concern Even with Dual Fuel Capacity

A 2017 report from the RTO that services New York state, NYISO, listed an increasing concern for the gas system to keep up with demand at peak times in the summer and winter, even though a substantial portion of generators already have dual-fuel capacity with both oil and gas capabilities.

According to David Flanagan, a representative with NYISO, the New York State Reliability Council also has rules that require switching from gas to oil at times of peak load for New York City and Long Island to ensure gas generating capability. Even so, a 2015 New York City law enacted banned the combustion of certain types of fuel oil because of particulate matter concerns beginning in 2020.

Less Concern in California, Texas

Robbie Searcy, a spokesman for the Electric Reliability Council of Texas, the RTO that oversees distribution for Texas, said that natural gas reliance isn’t as much of a risk for them since they have a robust pipeline network.

“We don’t see the same challenges that California or the northeast have related to distribution,” she said by phone.

Texas natural gas generation was impacted by the 2011 cold front, but Searcy said that the RTO has since planned for winter preparedness and doesn’t see that as an ongoing concern.

Steven Greenlee, senior public information officer for California ISO, the RTO servicing California, said that they aren’t seeing the resiliency issues even with a declining fuel diversity.

“California has a very aggressive renewables portfolio with the most solar power on the grid. We’re using less natural gas than before, and coal usage has already been eliminated in the state,” he said by phone.

But while California utilities haven't been impacted by cold fronts like the polar vortex, the leak at the Aliso Canyon natural gas storage facility did present reliability challenges for utilities in the Los Angeles basin, which relies on the facility during emergency conditions, Greenlee said.

On-Site LNG Not There Yet

Natural gas could be used as an on-site backup fuel in case of fuel transmission disruptions, but the technology just isn't there yet.

A 2016 PJM report listed on-site LNG as a possible idea, but it's still in the early stages of development and the costs would be substantially higher.