The Disappearance And Potential Return of Debt During the Pandemic

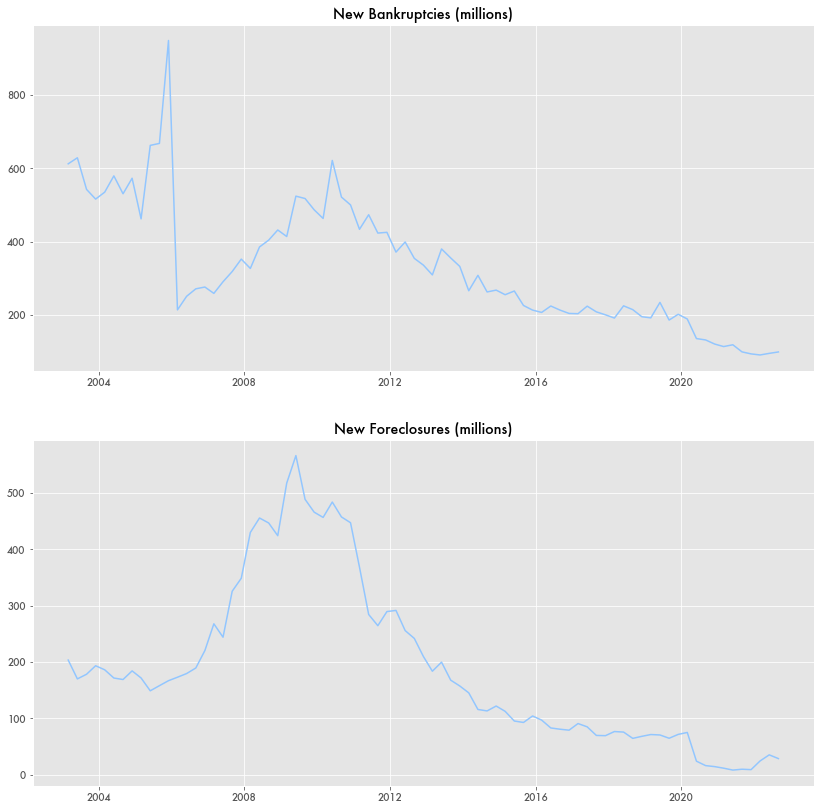

One positive aspect of the pandemic is that bankruptcies, foreclosures, and debt largely receded as the economy came to a standstill. Besides the government spending and Covid-era foreclosure protections as part of the CARES Act, more was being saved and less debt accumulated.

Loans and credit cards were paid off and the personal savings rate—the ratio of savings to disposable personal income—swooned from less than 10 percent to almost 35 percent, the highest it has ever been by far based on available Bureau of Economic Analysis (BEA) data.

But much of that may be short-lived. As the economy has come back, so has much of that debt. The personal savings rate, which had hit such epic highs, quickly swung back to the lowest it has ever been within a year.

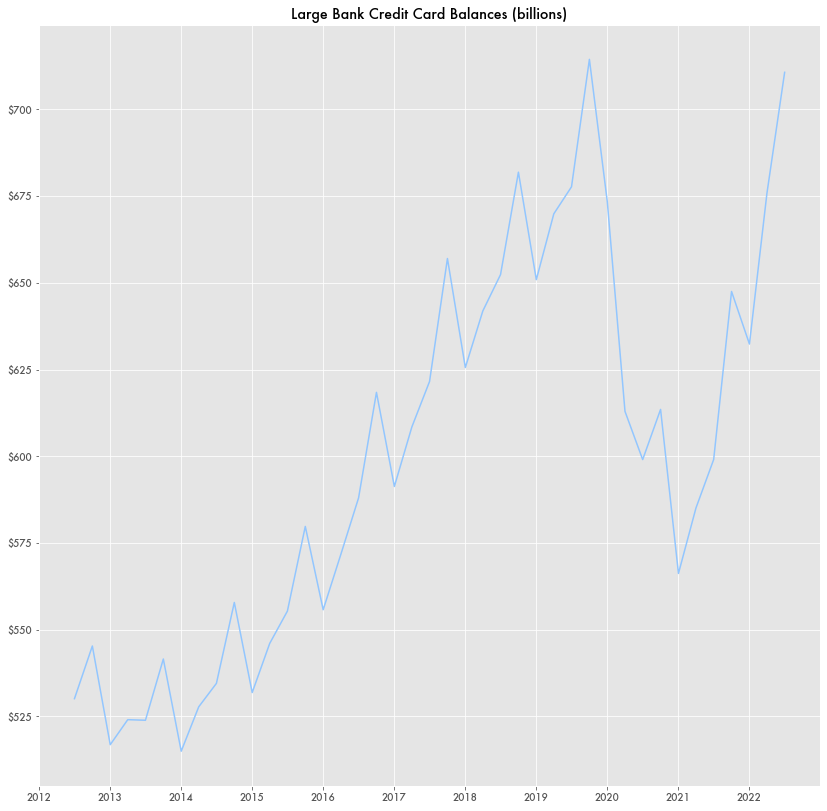

Similar to the personal savings rate, credit card balances at major banks would drop by over $125 billion only to swing back to their historic high that they were at pre-pandemic based on Federal Reserve data.

Consumer loans made a small drop only to spike up to effectively where they were on track to be if there were no pandemic.

Not all metrics zig-zagged back to where they were in 2020. Bankruptcies have been in continual decline, whereas foreclosures have ticked up, but are still lower than they had been.

The number of bank accounts in good standing (not delinquent) continues to be high, and the number of those that are severely derogatory continues to decline.