The Myths and Realities of the Vogtle Nuclear Reactor Construction

Vogtle units 3 & 4 are part of a nuclear plant in Waynesboro, Georgia completed in 2024 that is often described as the ultimate boondoggle in energy generation.

One of the most expensive energy plants built on the planet, it was eight years overdue. Total costs for the project are sometimes estimated between $31 and $37 billion—around $20 billion more than anticipated.

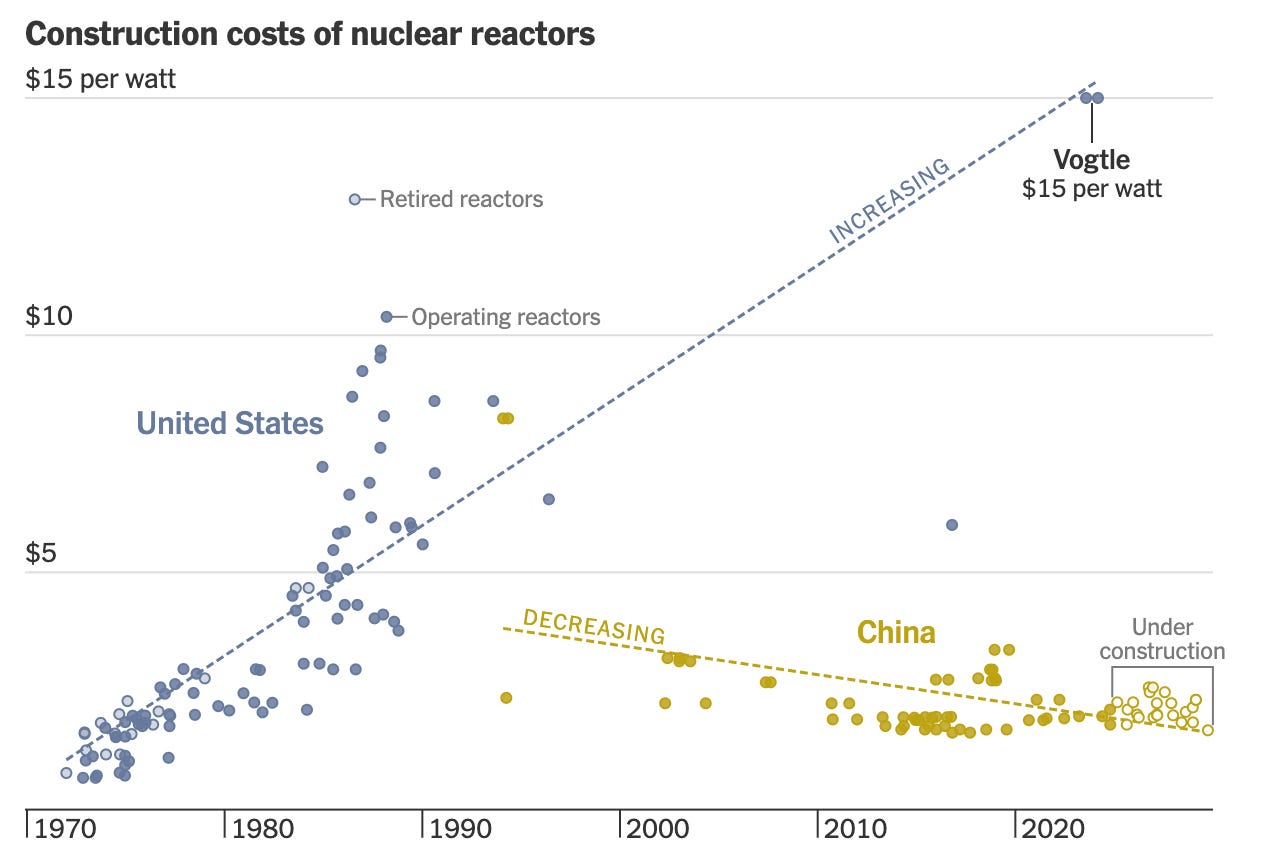

An infographic in Nature on nuclear cost estimates for Vogtle 3 & 4 put it at $15 per watt—three times higher than most other nuclear plant builds and far below that of recent Chinese reactors.

But more likely Vogtle’s total costs are below $27 billion based on annual reports from respective investing parties: Georgia Power ($11.6 B), Oglethorpe ($7.2 B), and Municipal Electric Authority of Georgia (MEAG) ($7.5 B). Each reactor has a nameplate capacity of about 1,117 megawatts, which puts its generation cost at around $12 per watt of capacity.

Still pricey, it was the first nuclear plant built in the U.S. in over a decade, and the implication was that nuclear was not safe, cheap, or feasible. Local Georgia politicians ran campaigns highlighting Vogtle’s excess spending and how the “Most Expensive Electricity on Earth” was set to cost taxpayers an average of $20 a month to their bill.

Much of it was bad luck. Plant construction was impeded by numerous global catastrophes: the pandemic, the Fukushima disaster, and the bankruptcy of Westinghouse—the original developer and funder of the project—each of which caused financial and regulatory delays.

Members of the U.S. Nuclear Regulatory Commission voted against it out of fear of natural catastrophes like September 11th and Hurricane Katrina causing meltdowns. The Fukushima earthquake forced a redesign of the plant that included reinforced concrete to prepare for a potential seismic event in Georgia. Numerous environmental groups sued to stop its progress and released reports critical of its safety.

While the project was certainly over-budget, much of that was expected as a first of a kind innovative development (FOAK)—something emblematic of nuclear energy development going back decades. Vogtle was the first model of the AP1000 (advanced passive) reactor design, using pressurized water, passive safety, and modular unit designs, something that would be copied and sold worldwide, particularly in China.

Westinghouse, originally an American company, developed the AP1000 technology over years, but it was bought out by a British company, British Nuclear Fuels Limited (BNFL), in 1999 after the parent Westinghouse company merged with CBS, who spun off the nuclear division as its own company.

It was then sold to Toshiba after a review by the Committee on Foreign Investment in the United States (CFIUS), who then sold off the company following its bankruptcy related to Vogtle financing.

While Vogtle would be used as an example of America’s inability to complete construction projects on time, China also struggled with issues in AP1000 reactor development despite not having to originate the design, and being able to benefit from repeated construction.

In China, AP1000 reactors took nine years to build on average—not that much quicker than Vogtle’s 10-11 year timespan—despite expectations that they would be built within four to five based on a 2025 report from the Department of Energy. That also includes some CAP1400 reactors—a design based on the Westinghouse AP1000 but with full Chinese patent rights.

The first pair of AP1000 reactors in Sanmen were estimated to cost CNY 32.4 billion yuan in 2008 but later estimates in 2013 gave figures of CNY 40.1 billion ($6.12 billion USD-2013). However, the final costs exceeded initial estimates due to various factors, including design modifications, equipment cost escalations, delays in response to evolving safety standards following the Fukushima accident, and changes in import taxation policies. The final sum was CNY 10 billion yuan higher ($1.46 billion USD2018) than the 2013’s estimation, resulting in a total of CNY 50 billion ($7.3B USD-2018)

While timelines are sometimes similar, Chinese nuclear construction is much cheaper than in the U.S.. But the two may not be comparable as Chinese construction benefits from much more government subsidies than the U.S. does.

Delays a Longstanding Issue With Nuclear

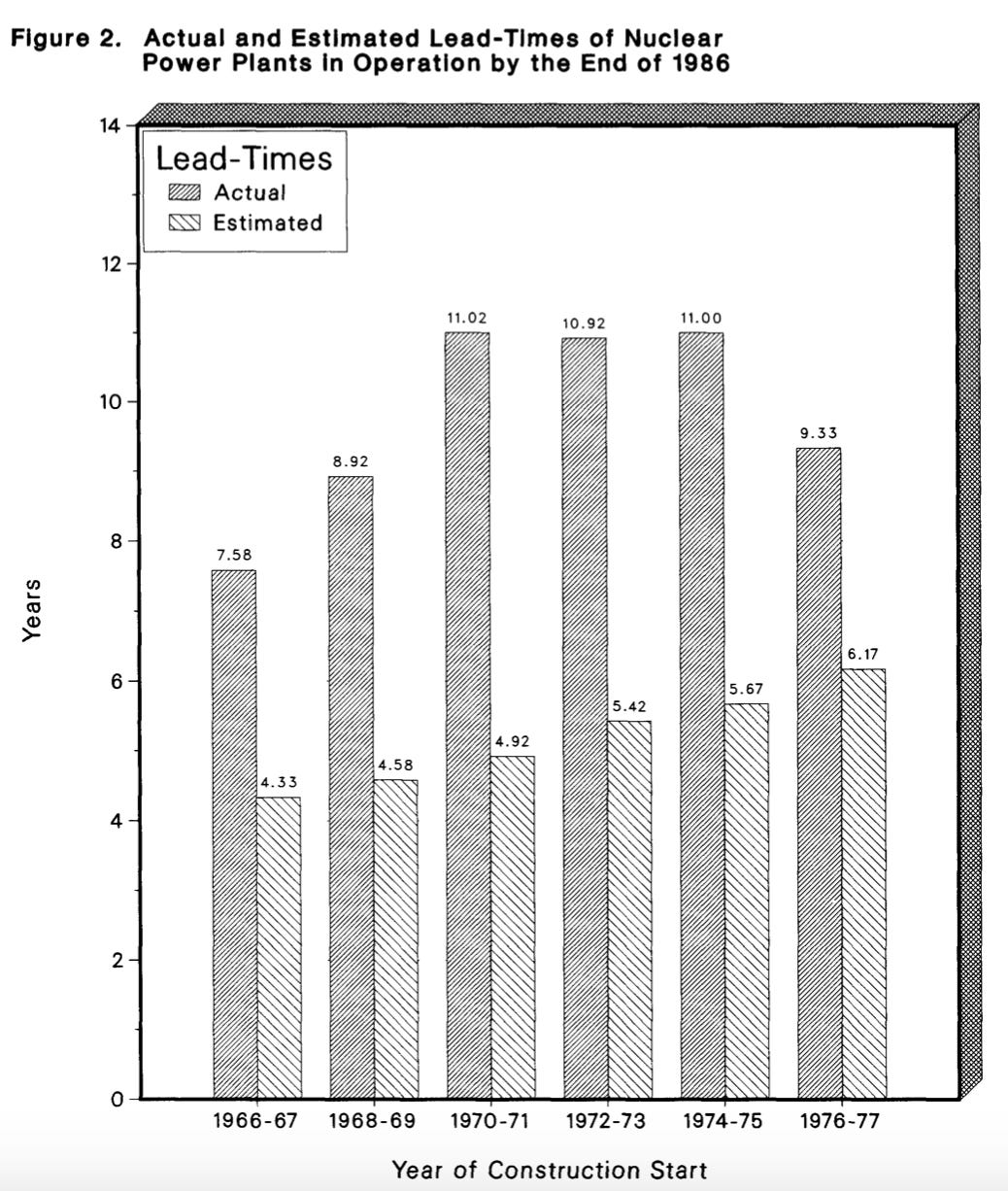

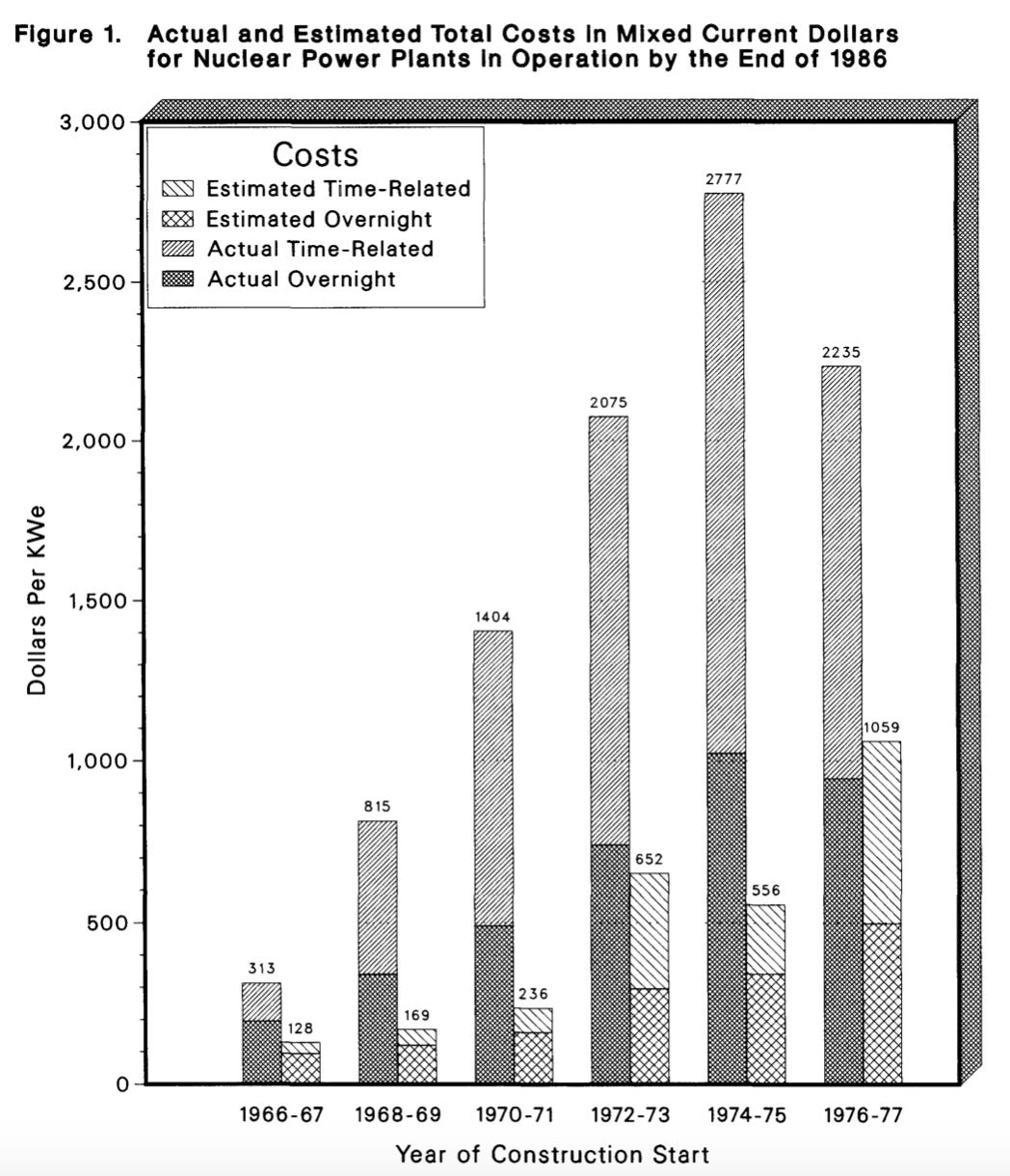

In general, most nuclear plants, even those going back to the 1960s, succumbed to the same flaws of overly optimistic timelines, new regulations, and constantly evolving technology that would push deadlines back, causing increased construction and capital costs, even before Three Mile Island and Chernobyl encouraged heightened nuclear safety measures. For megaprojects of that size, those delays mean more costs and more interest payments in the long term.

A 1986 report from the Energy Information Administration (EIA) shows how on average most reactor projects regularly went beyond their estimated completion times as construction demands and updated regulations forced changes midway through even as nuclear technology became well established.

Original Vogtle Reactors Went Way Over Budget

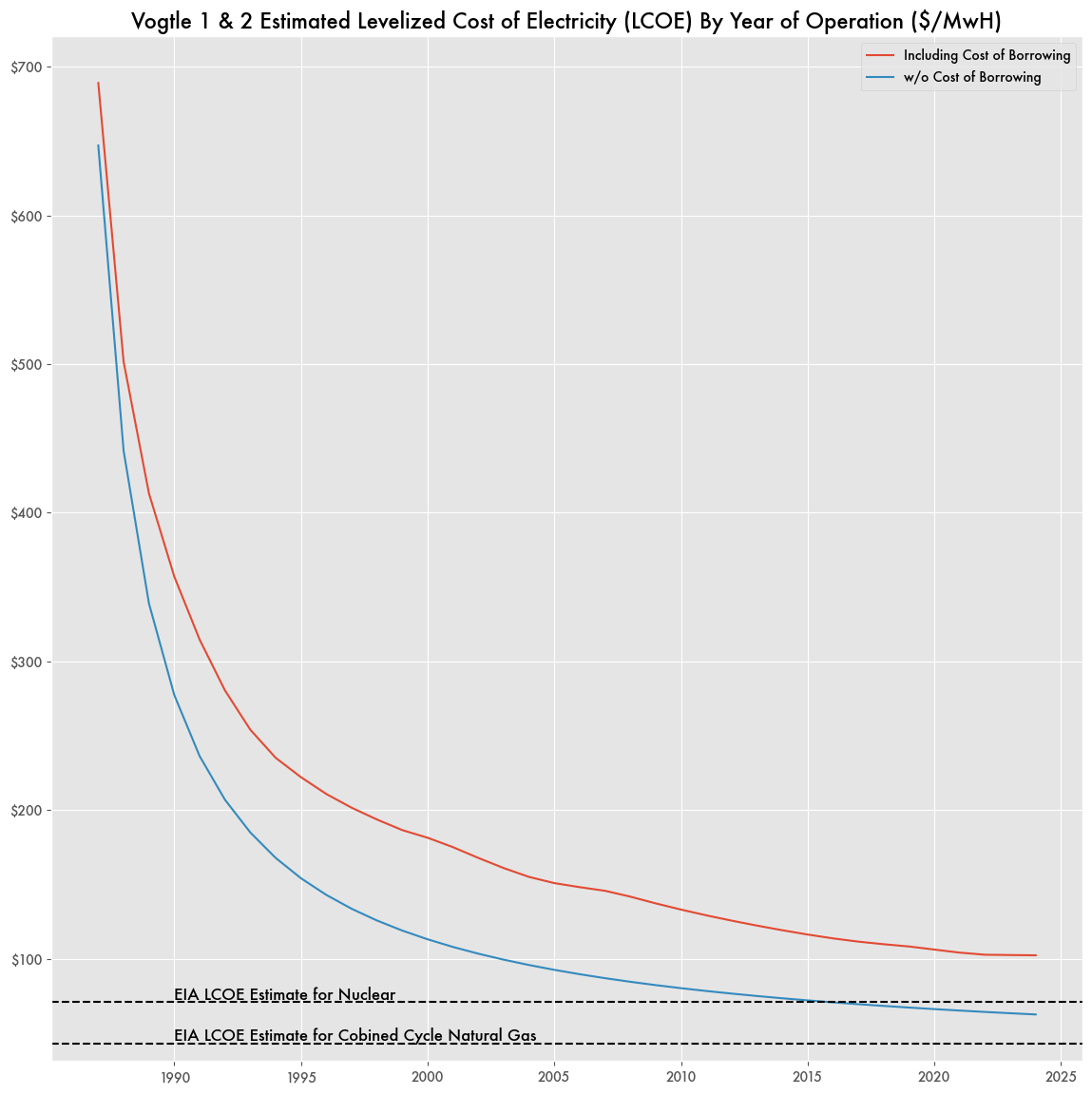

That also includes the previous Vogtle reactor units 1 & 2, completed in 1987 and 1989 respectively. Originally expected to cost $660 million, they ended up at $8.87 billion. In 2024 dollars, that works out to be around $24 billion for 2.236 megawatts of capacity—or $10.7 per watt—just under Vogtle 3 & 4’s $12 per watt.

Despite the excess upfront costs, the original reactors produce a hefty 19 terawatt-hours of electricity for the state a year—about 15 percent of the Georgia’s total energy consumption. Based on average Georgia electricity rates, they were annually generating somewhere between $2.5 and $3.2 billion (in 2024 dollars) worth of electricity for over 30 years.

How financially sound a nuclear plant is turns on those construction costs and how long it’s in operation for. In general, nuclear reactors can reap the benefit of their longer lifespans, as compared to solar panels that may need to be replaced after 20 years. Construction can be a complete boondoggle as long as the plant survives long enough.

That benefit to age is seen nuclear’s levelized cost of electricity, which becomes competitive with other sources after 20 years in operation, but it’s still hampered by the need to borrow capital to get around FOAK struggles.

To counter those upfront costs, investment in recent years has focused on small modular reactors (SMRs), that have lower borrowing needs and shorter turnaround times.