Twitter Financials Collapsed As Activist Investor Got Involved

According to a November Wall Street Journal story, Twitter has been hit with a series of financial struggles under the new ownership by Elon Musk. The company endured a massive loss in revenue and was losing $4 million a day, and its credit rating was downgraded by Moody’s and S&P.

It’s not immediately clear how much the recent sharp downturn is related to Musk’s ownership and his executive decisions or changes in the digital ad market. But Twitter’s financial troubles started well before Musk’s takeover.

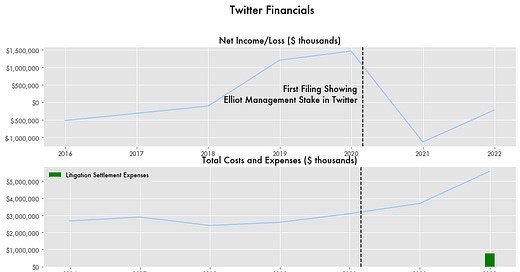

Between 2020 and 2021, the social media company’s net income would suddenly swing from the highest profits in its history to the largest losses in its history all the while seeing high revenue.

Paul Singer Steps In

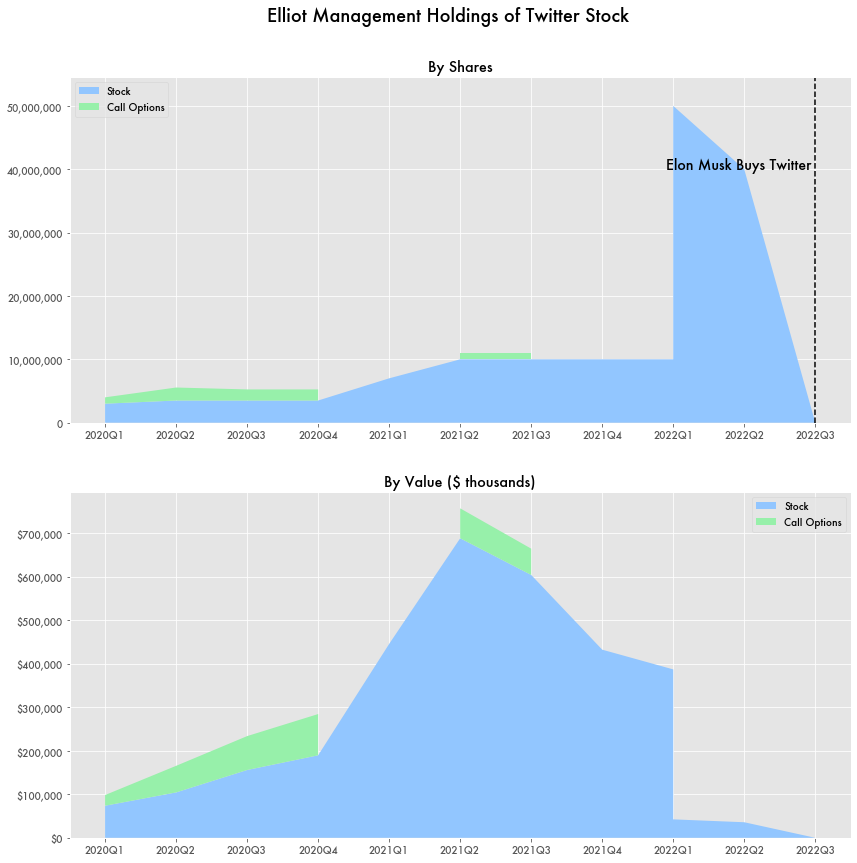

That year, 2020, is also when the investor Paul Singer of the hedge fund Elliot Capital Management would take an active interest in Twitter.

An initial investment of around 4 million shares (3 million in shares, 1 million in call options) would eventually become 50 million by the first quarter of 2022, making Elliot Management one of the top ten holders of Ticker stock according to Securities Exchange Commission 13-F filings.

Singer is not simply a passive investor, but well known as an activist investor who pushes for changes in the investments he takes on, whether they be public companies or sovereign governments issuing bonds. Sometimes dubbed a “vulture funds” and “financial terrorists”, they are known for taking advantage of struggling investments with strong-arm tactics.

And soon enough after targeting Twitter, he set his sites on Jack Dorsey, the head of Twitter at the time and one of its original founders. Eventually Singer would be successful and Dorsey would be pushed out of his role at Twitter with Parag Agrawal taking his place in November of 2021.

Hiring Sprees and Class Action Lawsuits

Activist investors are usually known for pushing management to cut costs for the benefit of profit margins, stock price increases, and shareholder returns. But Elliot Management would see the opposite during its involvement with the company: high spending and mounting debt.

The company would see the settlement of a large class action lawsuit for $765 million as well as a substantial increase in its employee headcount and overall costs and liabilities based on data from the company’s SEC filings and Statista. Net income of $1.5 billion in 2019 would become -$1.1 billion a year later.

That lawsuit, originally filed in 2016, was one of the largest settlements of 2021. It accused the company of deceiving investors about how many users were on the platform. The settlement would sink the company’s stock 3.8 percent on the day of its announcement.

Compare that settlement to a similar lawsuit brought against Facebook—inflating viewership metrics and hosting billions of fake accounts. That was settled in 2019 for a mere $40 million.

In early 2022, Twitter also agreed to a settlement of $150 million for privacy infringements.

Since Musk Takeover

Musk’s reign at Twitter has been contentious as he has been “cutting costs like crazy,” which involved laying off the company’s human rights and ethical artificial intelligence divisions.

Around the same time of Musk’s buyout, Elliot Capital Management sold off all its holdings in Twitter by the third quarter of 2022.