UnitedHealthcare Maybe Didn't Deny All That Much

The recent assassination of UnitedHealthcare CEO Brian Harrington has brought additional attention to the behemoth insurer who was accused of excessively high health claim denial rates—rejecting insurance claims for out-of-network care or other reasons.

The company denied the accusations by posting a note on their website clarifying that they pay out 90 percent of claims, not 33 percent as reported elsewhere.

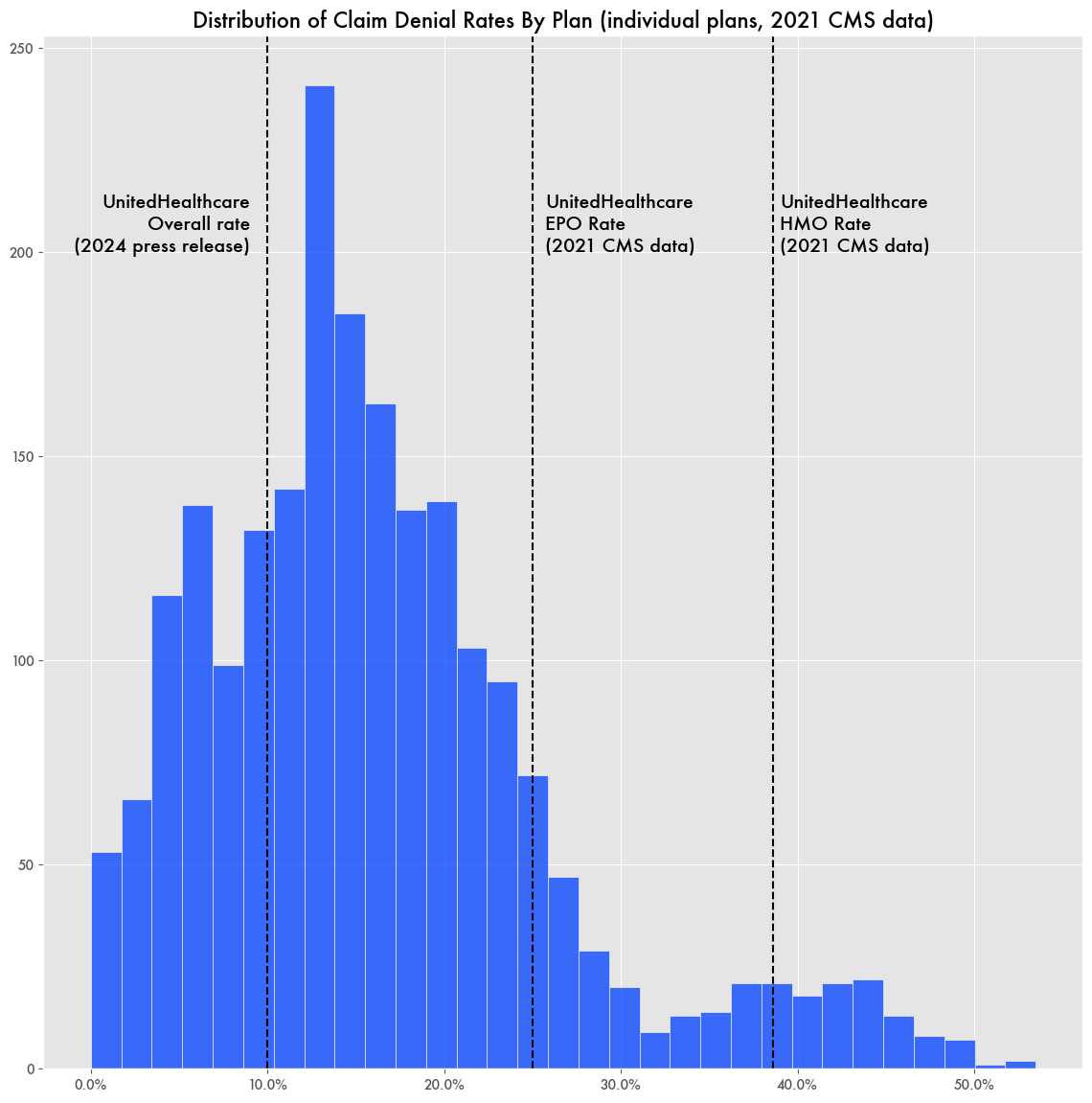

But an analysis of Centers for Medicare and Medicaid Services (CMS) claims rejection data shows their 2021 denial rate to be 39 percent for individual HMO plans and 25 percent for EPO plans—nothing close to the 10 percent stated in their press release.

While those rates could be high, they are not the highest in the industry where other insurers like Meridian Health have overall denial rates of 49 percent. UnitedHealthcare ranks ninth in that list. Blue Cross Blue Shield has the largest number of claims in total and an 18 percent denial rate. (note: insurers are grouped by naïve parent company by name but this does not account for ultimate parent ownership).

UnitedHealthcare had a slightly higher appeal rate for denied claims than the average—4 percent as opposed to 1 percent—possibly indicating that more of UnitedHealthcare’s denials were illegitimate, but then there are also insurers like Christus Health with appeal rates around 25 percent.

CMS Data Potentially Misleading

Which number is right for UnitedHealthcare’s denial rates? There might be reason to doubt CMS’s numbers as there are odd discrepancies in the data. For example, of the 6,764 plans listed in the CMS data, a full 69 percent list no claim denials. With Cigna’s Kansas EPO Gold plan, they list only 17 total claims denied but also somehow 1,165 claims were denied for “Other Reasons.”

If UnitedHealthcare’s press release was blatantly inaccurate, they could be liable under Securities and Exchange Commission (SEC) rules against misleading information by a public company.

United’s Market Dominance and Suspicious Activity

United Healthcare has been on a spending spree since the passage of the Affordable Care Act (ACA) through vertical and horizontal integration—buying up smaller insurers and also physician groups like Optum—the largest employer of physicians in the U.S.—and other healthcare industry components, like Change Healthcare, which handles around two-thirds of all medical transactions through its network.

A Brookings Institution report noted that such vertical integration enables healthcare companies to navigate around restrictions in the ACA, specifically the medical loss ratio—which requires healthcare insurers to spend at least 80 to 85 percent of their expenses on healthcare rather than administrative costs—by altering transfer prices.

The medical loss ratio rule championed by previous Minnesota Senator Al Franken was ostensibly meant to encourage health care over corporate profits, but since the ACA’s enactment health insurance costs have significantly increased.

The buying spree, specifically the purchase of Change Healthcare, led to UnitedHealthcare being the target of a Federal Trade Commission (FTC) antitrust investigation. The investigation details the potential of United’s control of such a large share of medical data would give the company an unfair advantage. But the case was quickly thrown out in 2021 without appeal.

The antitrust investigation is also what led CEO Harrington to dump some of his shares, leading to a separate insider trading investigation by the SEC.

Once United bought up Change, CEOs at the company sold off large shares following a ransomware attack that targeted Change Healthcare. While Change Healthcare was incapacitated, physician groups that depended on the service were unable to bring in revenue, crippling them financially and forcing them to be sold off to Optum.

A representative for UnitedHealthcare told the publication Health Care Un-covered that the sale of shares by executives would not be considered insider trading during a material event blackout period—the ransomware attack—because they were pre-planned transactions related to tax liabilities. Pre-planned stock sales, like that of 10b-1 sales, have been noted for abuse by insider trading for some time now.

UnitedHealthcare has also been at the center of a fight over how to handle Medicare risk factors. Insurers through the Medicare Advantage program have regularly overestimated the risk category of patients, earning them higher paybacks from Medicare. UnitedHealthcare fought with CMS on the rule on how insurers should pay back funds when such inaccuracies are found.