Vastly More Home Sales Than Actual Mortgages

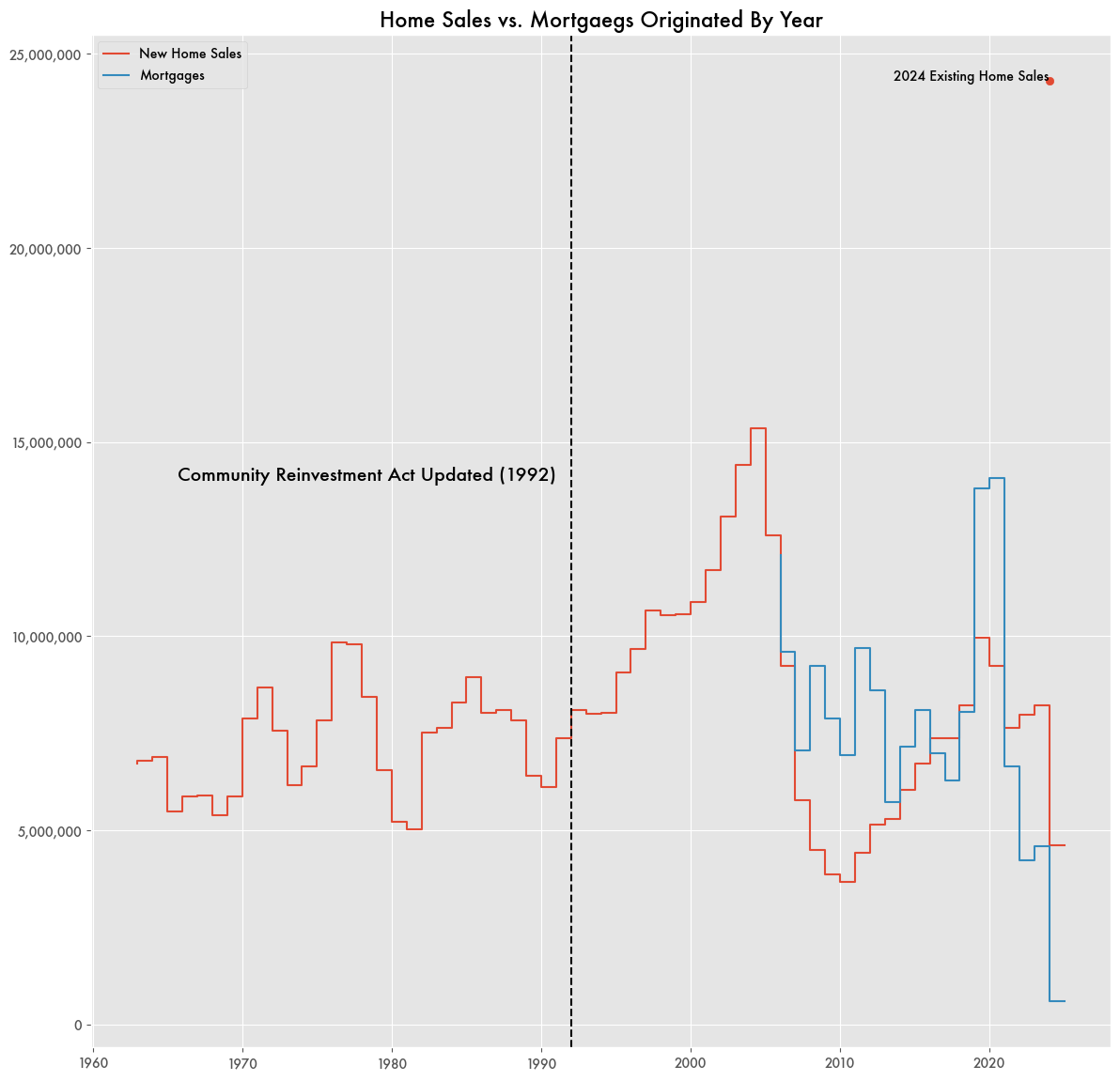

According to Consumer Finance Protection Bureau (CFPB) data, in 2024 there were almost 4.6 million mortgages originated, which includes the application, processing, underwriting, and actual funding of the cost to buy a home.

Yet U.S. Census data on new residential home sales for 2024 was 8.2 million, somehow a full 3.6 million higher than the number of total mortgages. And that doesn’t include existing home sales for that year, which was an additional 24.3 million.

Somehow millions of homes are being sold without identifiable mortgages. The large gap in the numbers makes it appear that a large proportion of home sales are either all cash purchases or mortgages that are not underwritten by the federal government and therefore not tracked in federal statistics.

Ostensibly, those untracked real estate loans would be the subprime loans and equity loans that defined the subprime crisis. Subprime loans are not underwritten by the government sponsored entities (GSEs) like Fannie Mae and Freddie Mac.

Previous research estimated that subprime loans amounted to a hefty 15 percent of the mortgage market at their peak. But the vast number of new home sales compared to underwritten mortgages makes it seem like non-underwritten loans accounts for more like 50 percent of real estate lending at times.

The data may also not make any sense. At a time in 2006, the number of mortgages originated tracked almost exactly the number of new homes sold—around 12 million. That might make sense if it included existing home sales—a regular mortgage for every home sale—but it doesn’t.

Instead, existing home sales can account for almost 25 million sales in a year—10 to 15 million more than the number of mortgages. That would make the size of the subprime and other real estate loan market that isn’t underwritten more like 88 percent.

Historic sales data on existing homes can be difficult to come by. Recent numbers from the National Association of Realtors only goes back to 2024.

Larger Gap in the 1990s

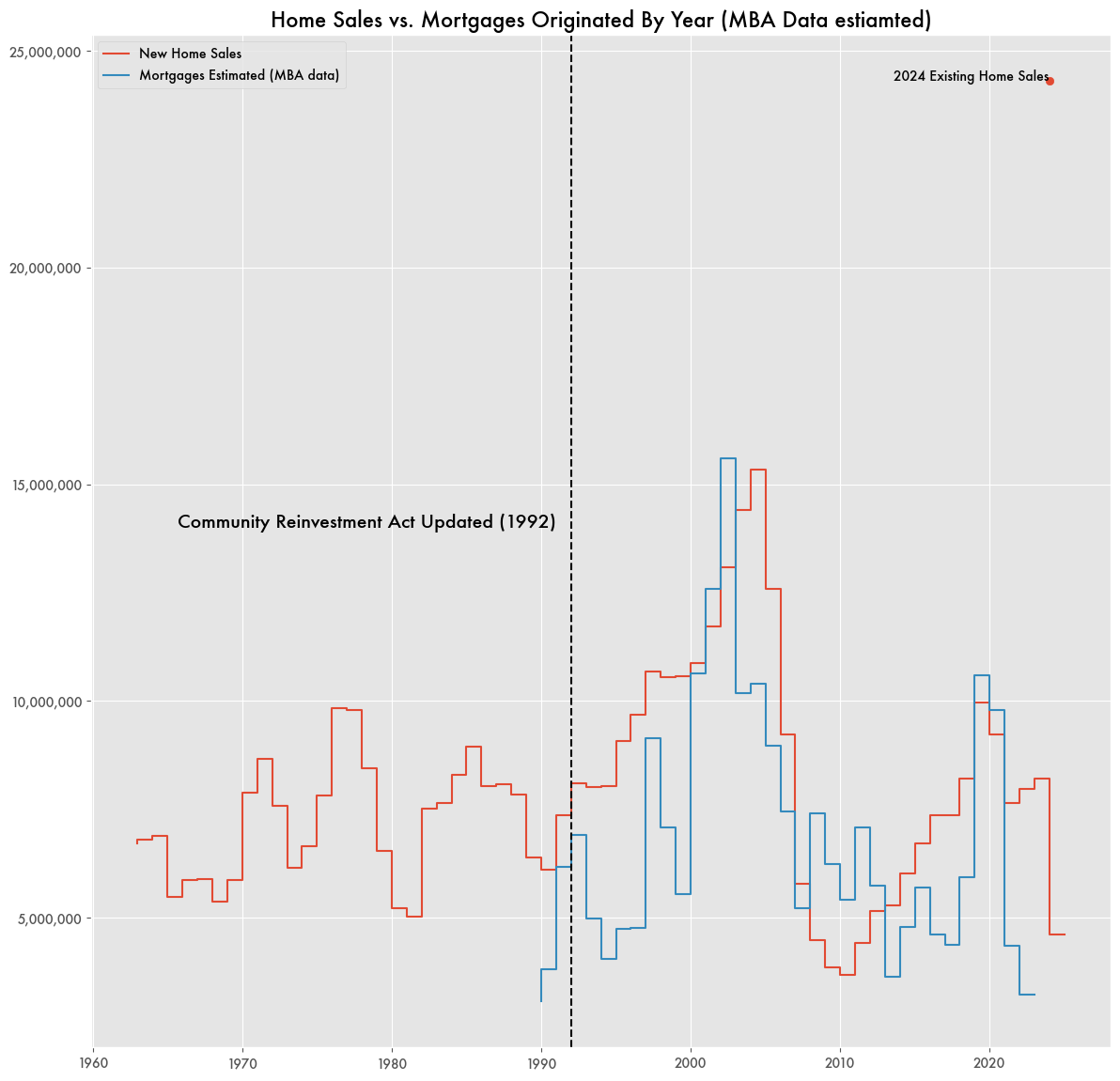

While the current discrepancy between home sales and mortgages is large, it might have been even larger at certain times in the 1990s.

Based on Mortgage Bankers Association (MBA) data for total mortgage value and average home price per year from the U.S. Census, the total number of mortgages in the 1990s might have been much lower than new home sales. In 1996, there were 4.9 million fewer mortgages than new home sales.

Home sales went higher and higher throughout the 1990s following changes to housing policy under the Clinton administration. It wasn’t until the 2000s that mortgage origination numbers quickly caught up with new home sales. In 2002 was one of the few times that mortgages outpaced new home sales—by approximately 8 million—but again, this doesn’t include existing home sales.

Discrepancies Tie In to the Subprime Crisis

A large amount of untraceable or non-underwritten mortgages might help explain the size of the shadow mortgage market, which was the center of the 2007-2008 financial collapse. Other data from that period showed a sizably larger amount of real estate loans compared to the size of mortgage-backed securities, and the mortgage servicer at the center of the collapse, Countrywide, had a servicing portfolio of $1.28 trillion—far above what was underwritten by Fannie Mae and Freddie Mac.

Countrywide’s sloppy origination practices would have been curtailed since 2009 since they were considered at the heart of the financial collapse. But with home sales currently almost six times the number of mortgage originations implies the practice may not have gone away.