The Complete Collapse of California’s Oil Refining Industry

Back in the year 2000, gasoline prices in California were not that different from the national average—$1.5 per gallon in California compared to $1.30 nationwide.

The Golden State was blessed with abundant petroleum resources and produced on average of 70 million barrels of finished gasoline a day. But over the course of 20 years California has gone on a warpath against pollutants tied to gasoline combustion, enacting the strictest standards for gasoline in the nation. As a result, California gasoline prices are now near twice the national average—the highest in the nation next to the island state of Hawaii—often above $5 a gallon with some gas stations going as high as $10.

There was originally a reason for the air pollution controls. Back in the 1940s Los Angeles was the smoggiest city in the country because of its basin geography and heavy reliance on cars. Visibility at times was nonexistent.

Much of that went away with the development of catalytic converters, unleaded gasoline, and better fuel efficiency, but in the 2000s California made extra efforts above and beyond those improvements, much of it aimed at carbon emissions.

In 2003, the California Air Resources Board (CARB) required gas stations sell a cleaner version of gasoline than anywhere else in the nation—California Reformulated Gasoline (CaRFG)—a mixture of California Reformulated Blendstock for Oxygenate Blending, otherwise known as CARBOB, mixed with ethanol.

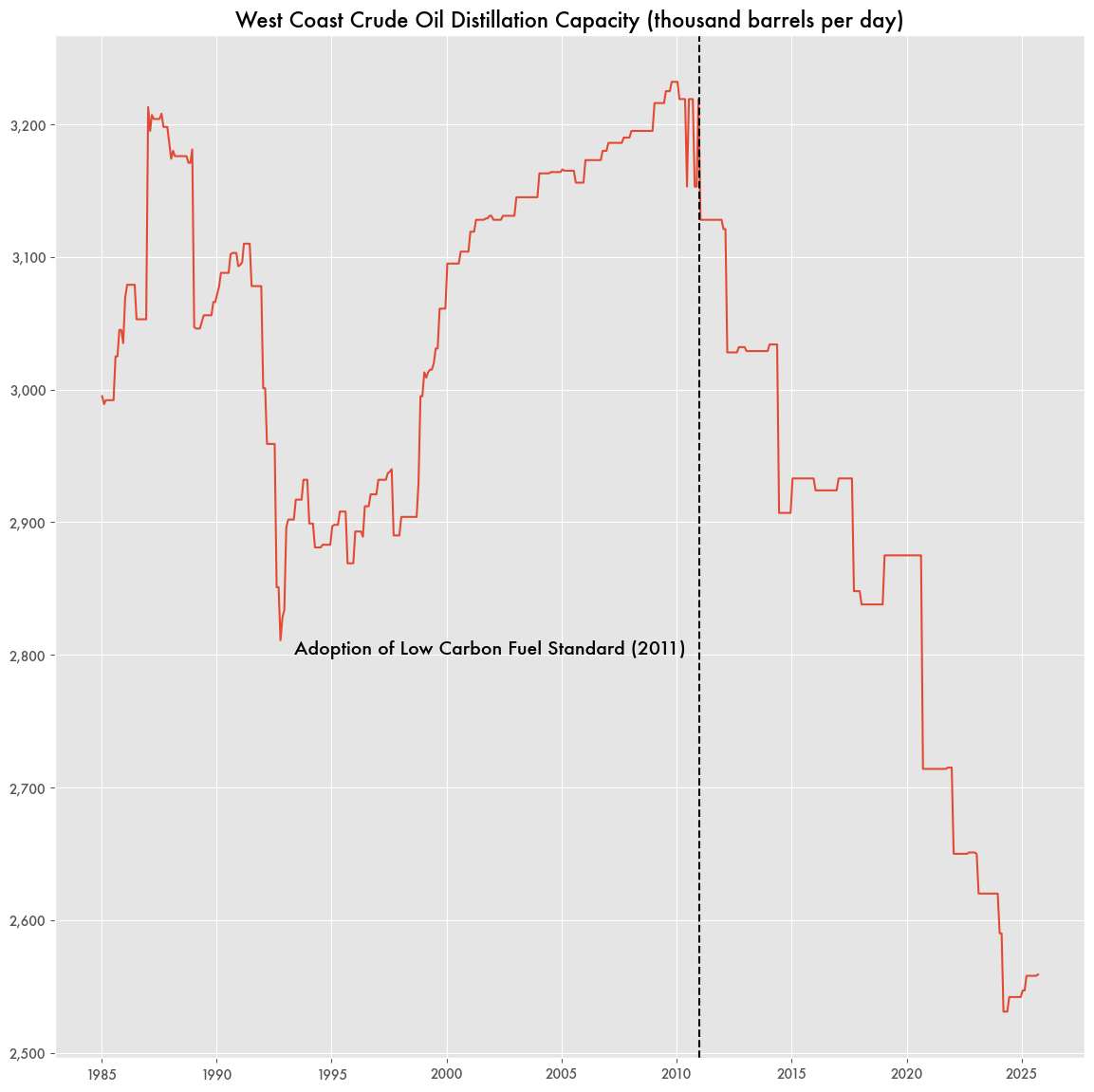

In 2011, California went even further by implementing the Low Carbon Fuel Standard (LCFS), putting additional restrictions on carbon emissions from gasoline and other sources.

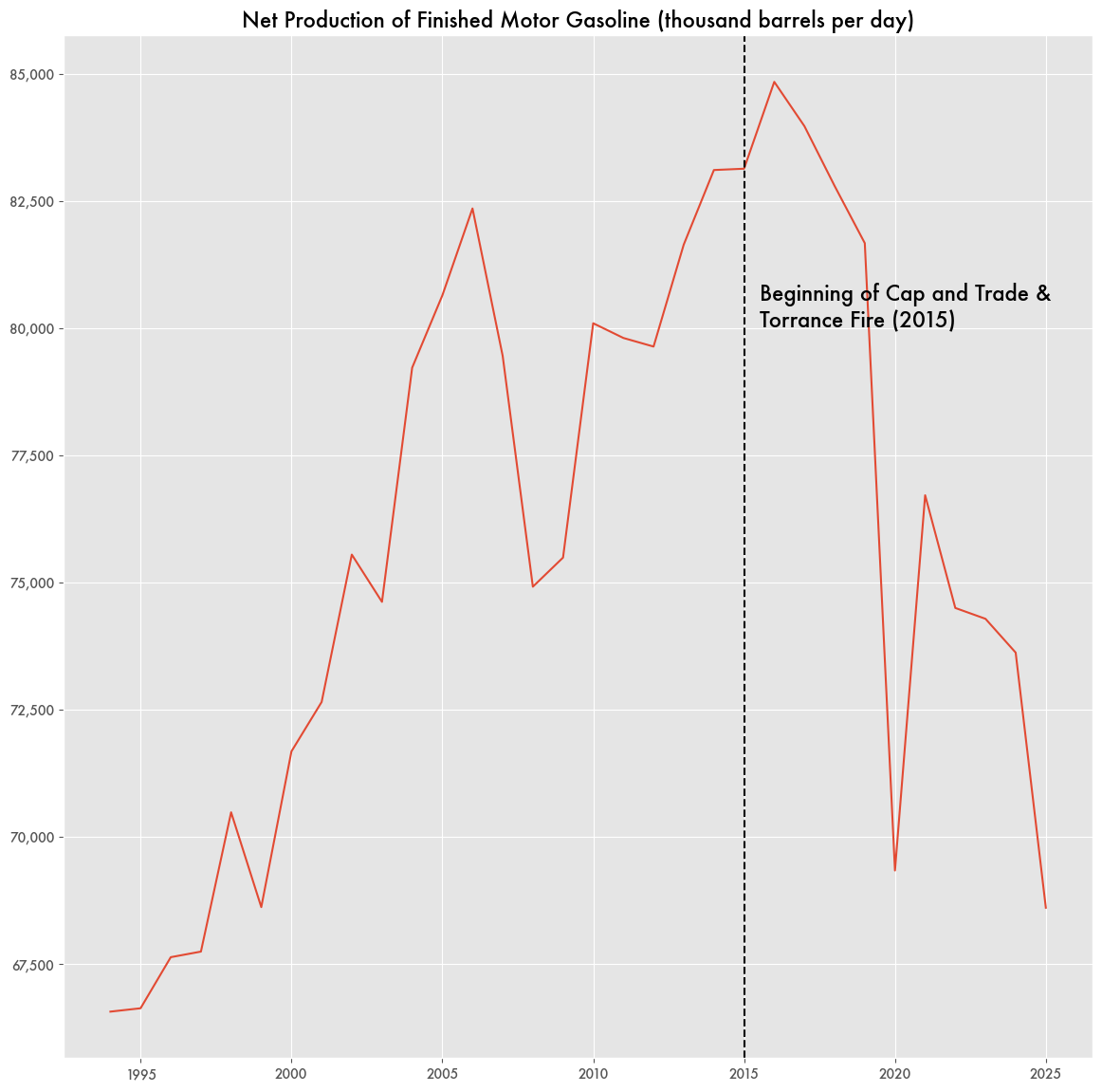

In 2015 it became the first state to sign on to cap-and-trade—enforcing state industries to limit their carbon dioxide output or be required to purchase carbon offsets in a private market from other industries that reduced carbon dioxide.

The result is that California industries, largely oil refineries, foot the bill of around $154 million annually on credits for things like forest management and livestock gas capture.

Between the California Air Resources Board, the Environmental Protection Agency (EPA), and various other trigger happy regional environmental regulators under a strict regime, refineries regularly get hit with large fines for air quality violations, lackluster reporting, or both.

A 2024 bill tripled the maximum penalty for air quality violations. Following that, CARB fined Valero’s Benicia refinery $82 million in October of 2024—the largest fine on record for the organization.

Besides CARBOB, cap-and-trade, and air quality standards, other state legislation forces refineries to maintain minimum gasoline inventories.

The combination of those efforts has put the squeeze on the state’s oil refineries. The limitations of producing gasoline to the CARBOB standards combined with the ongoing environmental fines would decimate domestic refining capacity. An attempt to limit refinery profits earlier this year was put on pause because too many refineries were shutting down.

On top of that there would be major outages at the Exxon Torrance refinery in 2015, as well as Valero’s Benicia refinery and PBF Energy’s Martinez refinery in Contra Costa County in 2025, all of which would send gasoline prices in the state even higher.

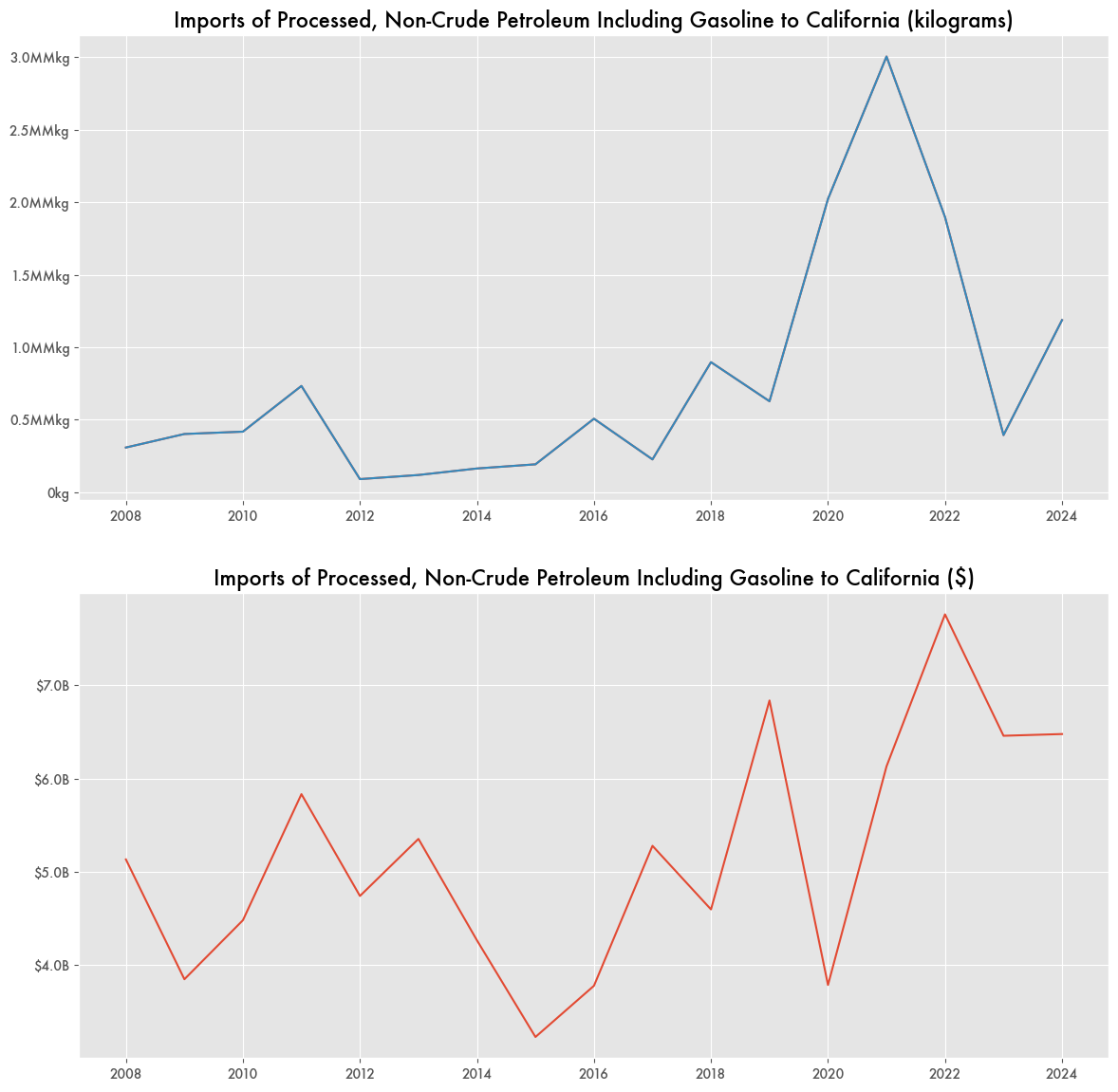

The end result is that California just doesn’t produce nearly as much gasoline as it once did. Instead, gasoline is imported from India and South Korea—six times more than it did ten years ago by weight of finished gasoline.

Following the Torrance refinery fire and start of cap and trade, net production of gasoline on the West coast went into freefall—dropping by around 15 million barrels a day in a few years.

The requirement of the CARBOB formulation in 2003 drove prices far and above the national average; the pandemic and refinery closures since 2020 drove them even higher.

The implementation of LCFS would decimate distillation capacity for the West coast, declining by almost a million barrels a day since 2011.